Acre: Simplifying DeFi Lending and Borrowing with Clear Risk Management.

Context

Acre, a pseudonym for confidentiality, is a sports betting platform that uses stablecoins. It previously provided these tokens to Venus, a DeFi lending protocol, to earn yield.

To reduce external dependencies and capture more value, Acre made the decision to build its own lending platform—and also give builders the tools to create their own permissionless lending pools.

Problem

DeFi lending can be very complex for users. Borrowing flows are often confusing, and liquidation risks are unclear. This is exemplified when Aave liquidated $170 million in user collateral during the May 2021 crash.

For DAOs and small builders, building lending pools from scratch is costly and hard. Ethereum deployments can cost over $500 just in gas fees.

Solutions

To address these challenges, I:

- Simplified borrowing flows and clarified risks, with an intuitive interface that made actions and outcomes easier to understand.

- Worked within existing infrastructure to design pool creation flows. This made it easier for builders to create their own lending pools.

Impact

Our UX work supported investor conversations through interactive prototypes and helped engineers plan implementation by mapping multiple edge cases. The work remained valuable even though the product paused pre-mainnet.

Role

Product Designer (Web App UX & User Flows)

Team

Hugbo Clement - Product Lead

Enebeli Oluchi - Product Manager & UX Researcher

Marvellous Aigbe - Product Designer (Mobile)

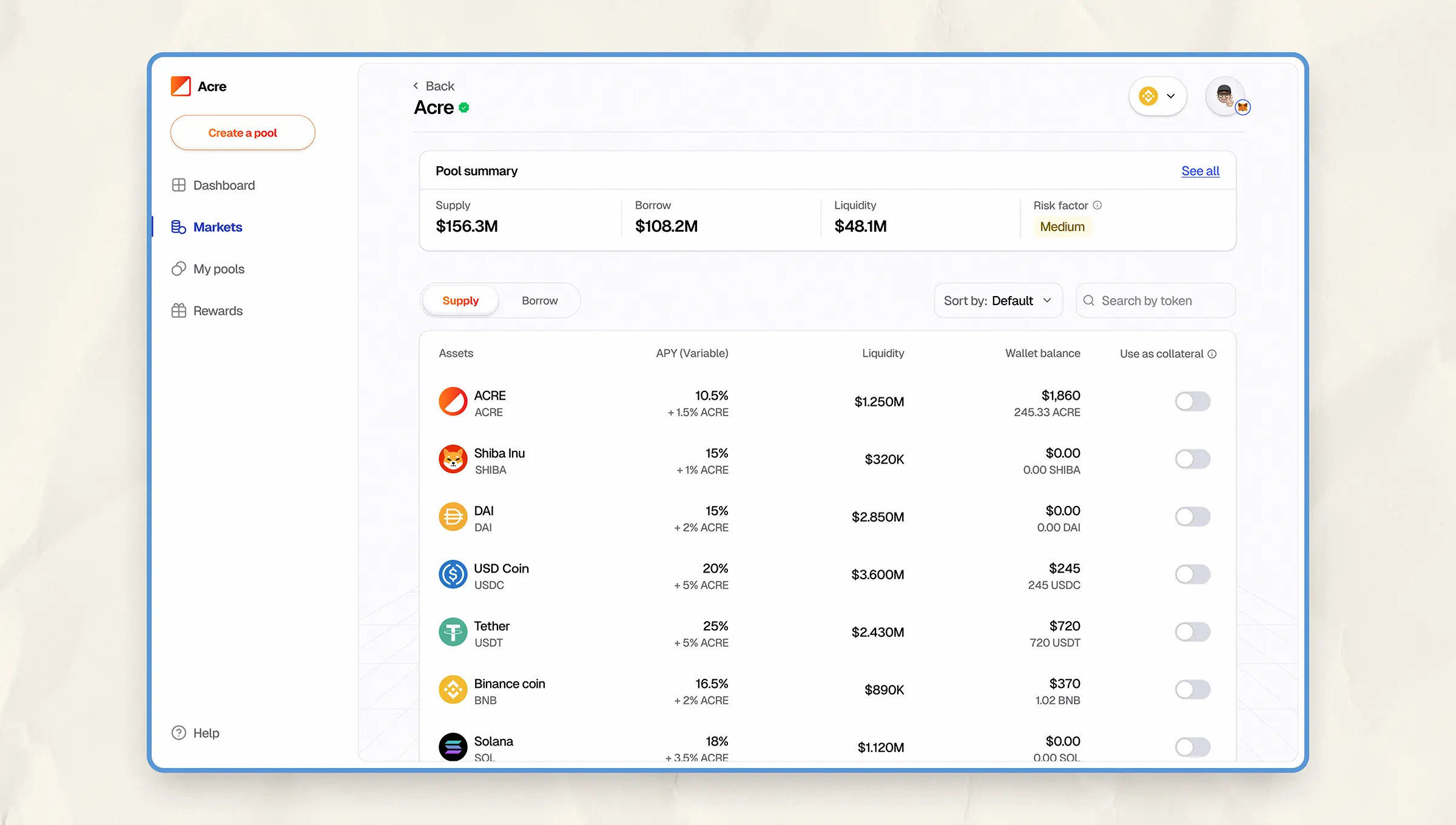

Helping Users Choose the Right Pool

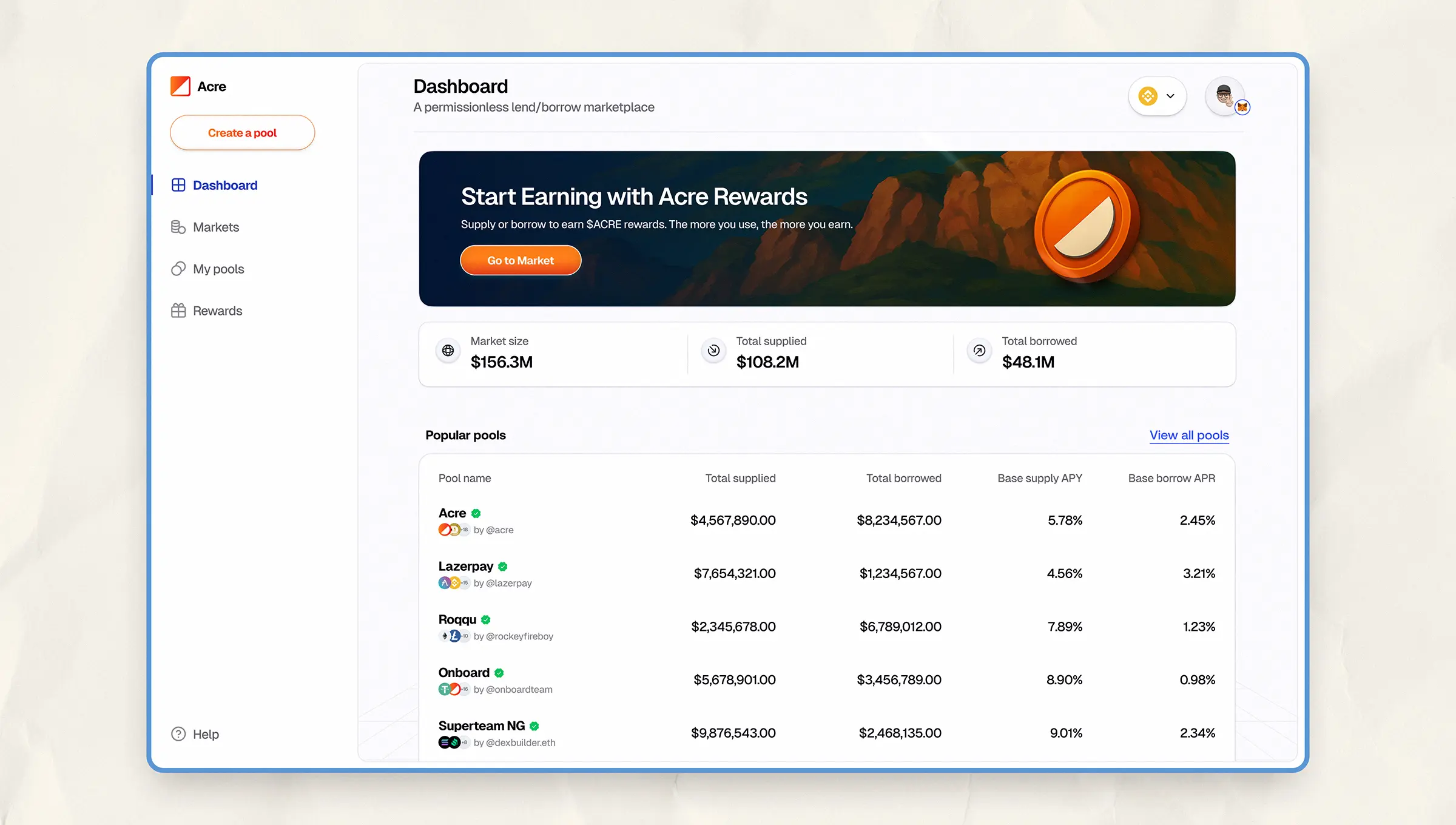

Before users supplied or borrowed, they needed to know what they were getting into. Each pool came with its own rules, risks, and rewards. We designed the UI to help users quickly assess:

- Who created the pool and whether it’s verified,

- Key stats like total supply, borrow, APY, and APR,

- Overall risk score , simplifying risk perception for newer users,

- A deep-dive view showing full pool configuration, token settings, fees, and permissions.

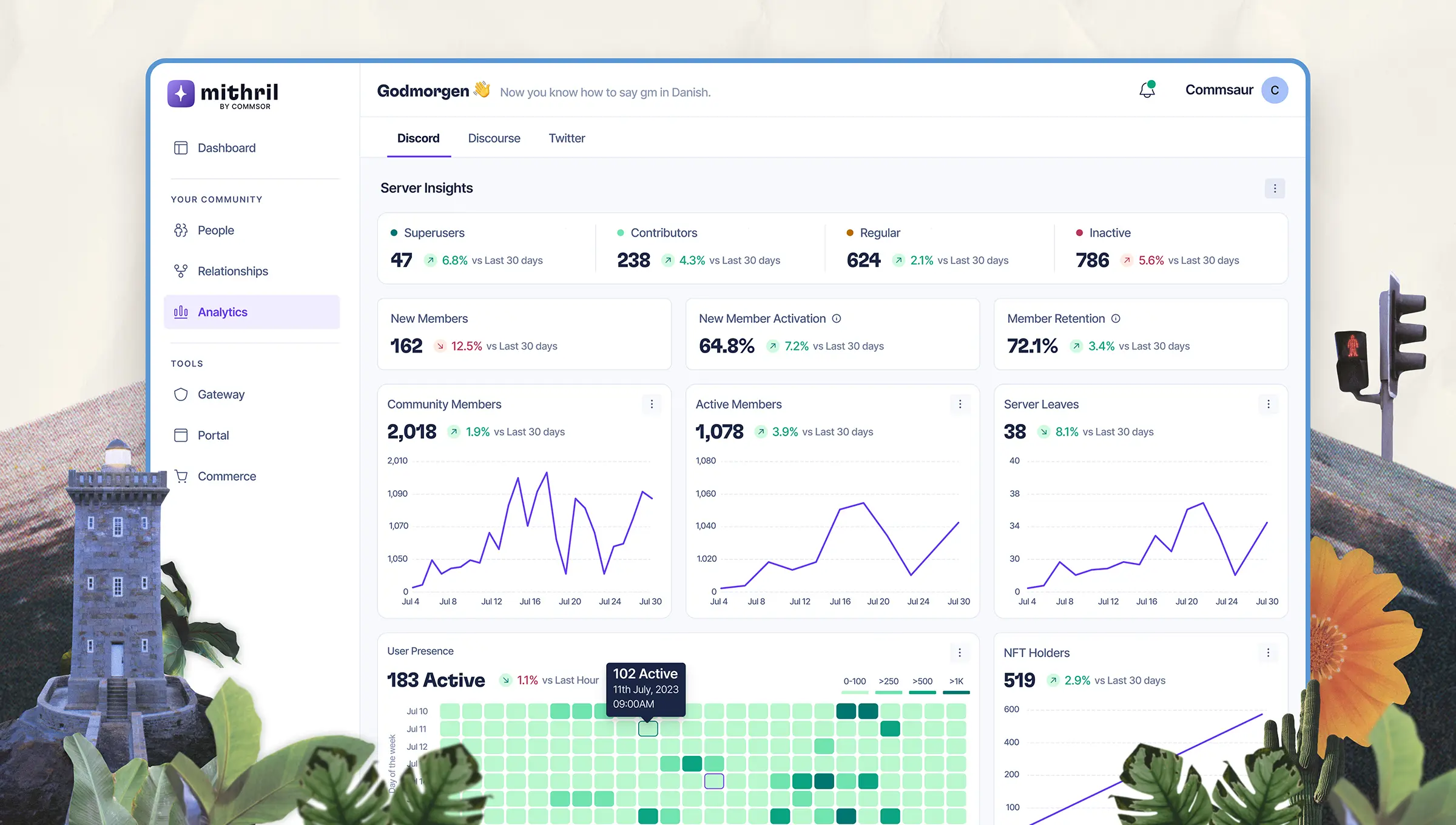

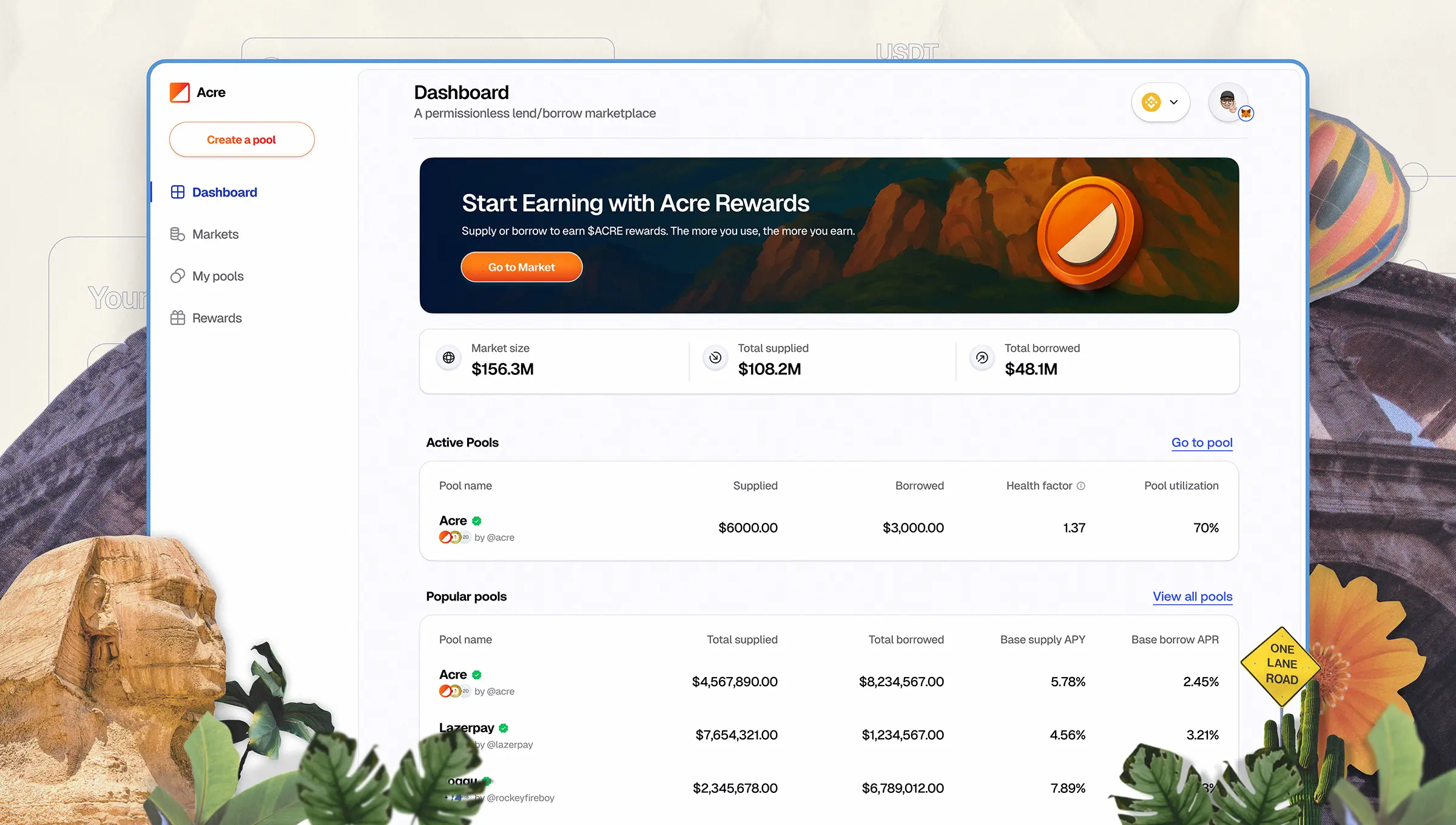

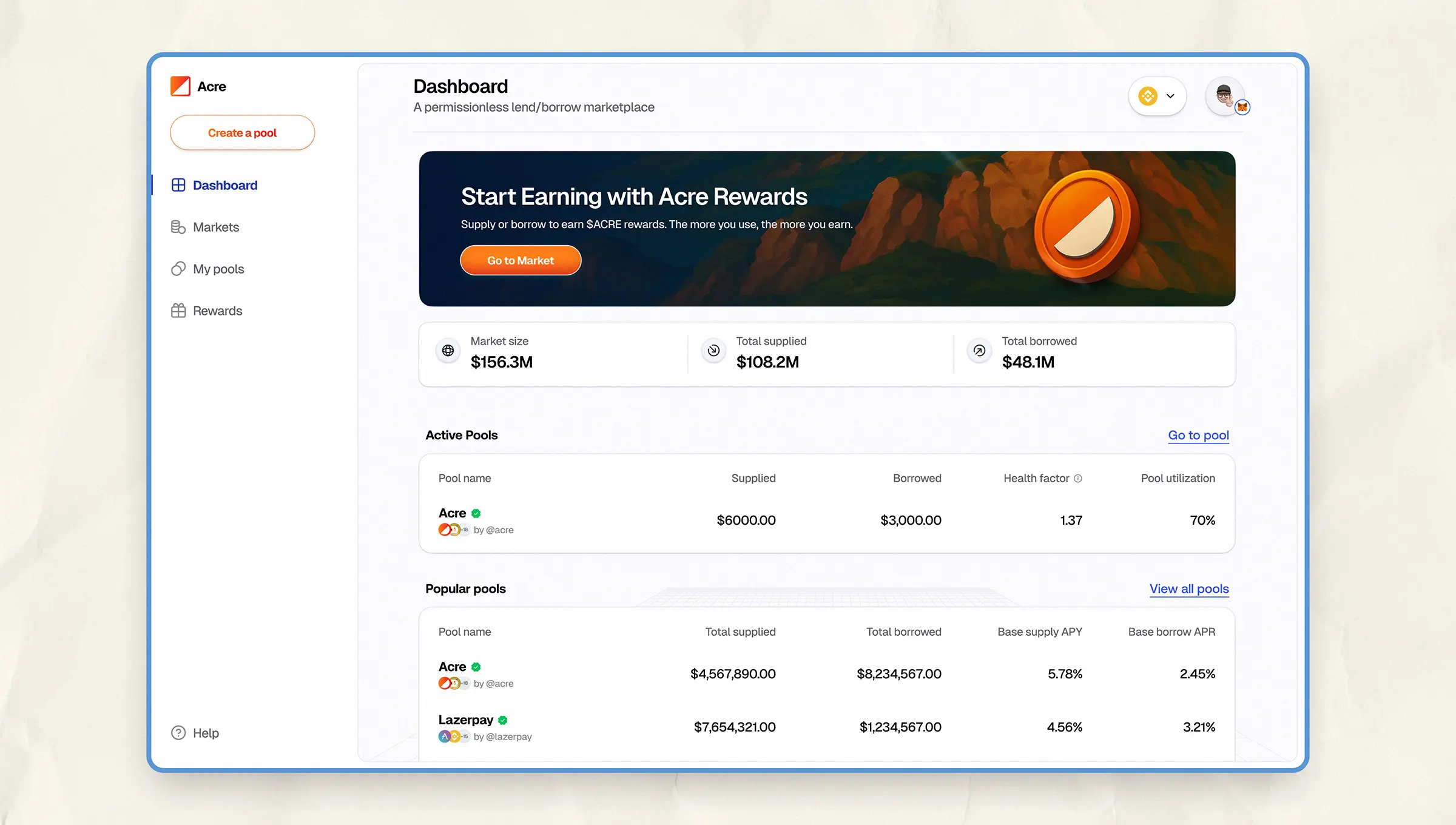

Acre’s dashboard showing market overview, total supply/borrow stats, and a list of top-performing lending pools, making it easy to compare options.

Users can explore asset-level details within each pool, including APYs, available liquidity, and collateral status, before making decisions.

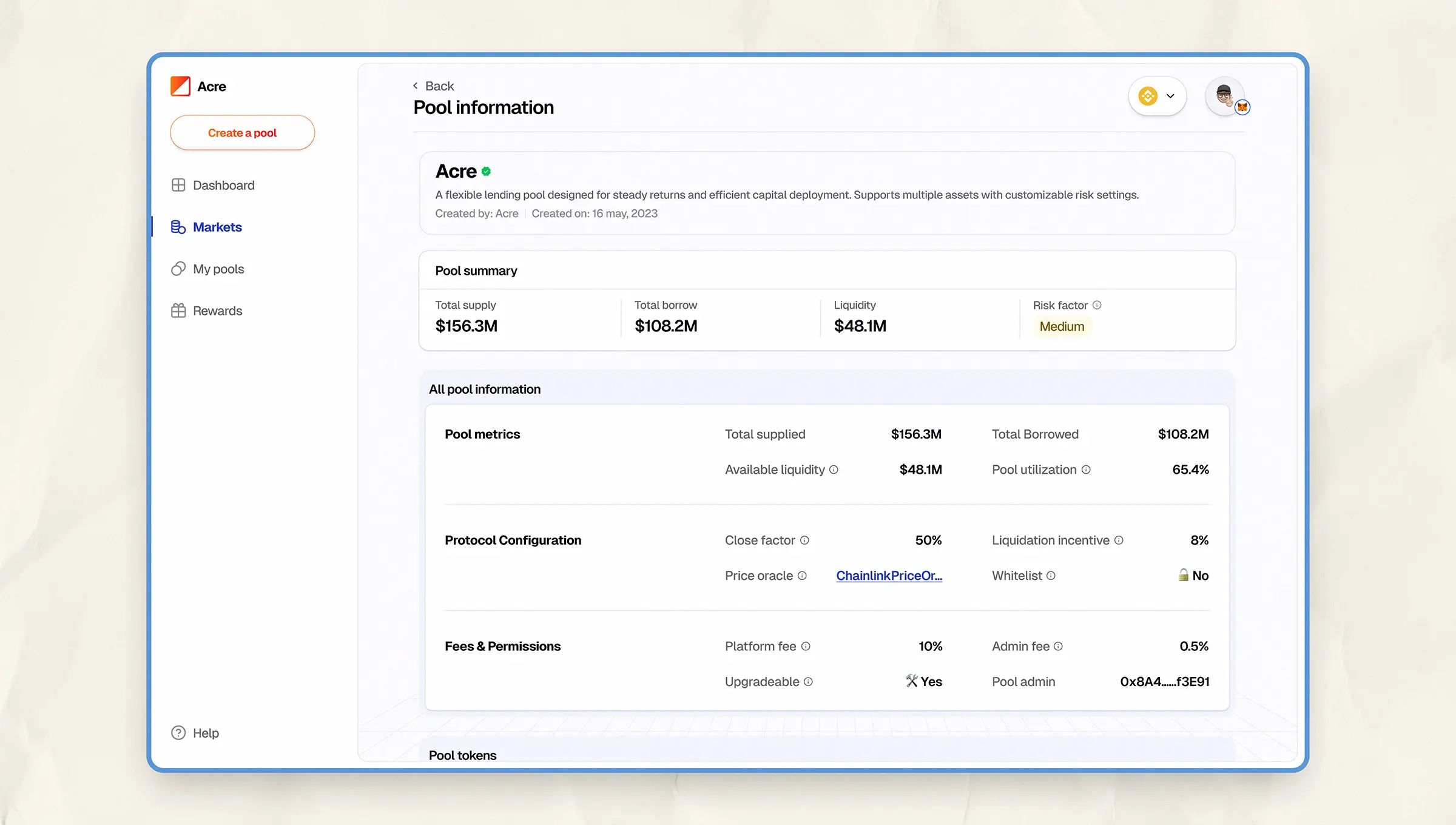

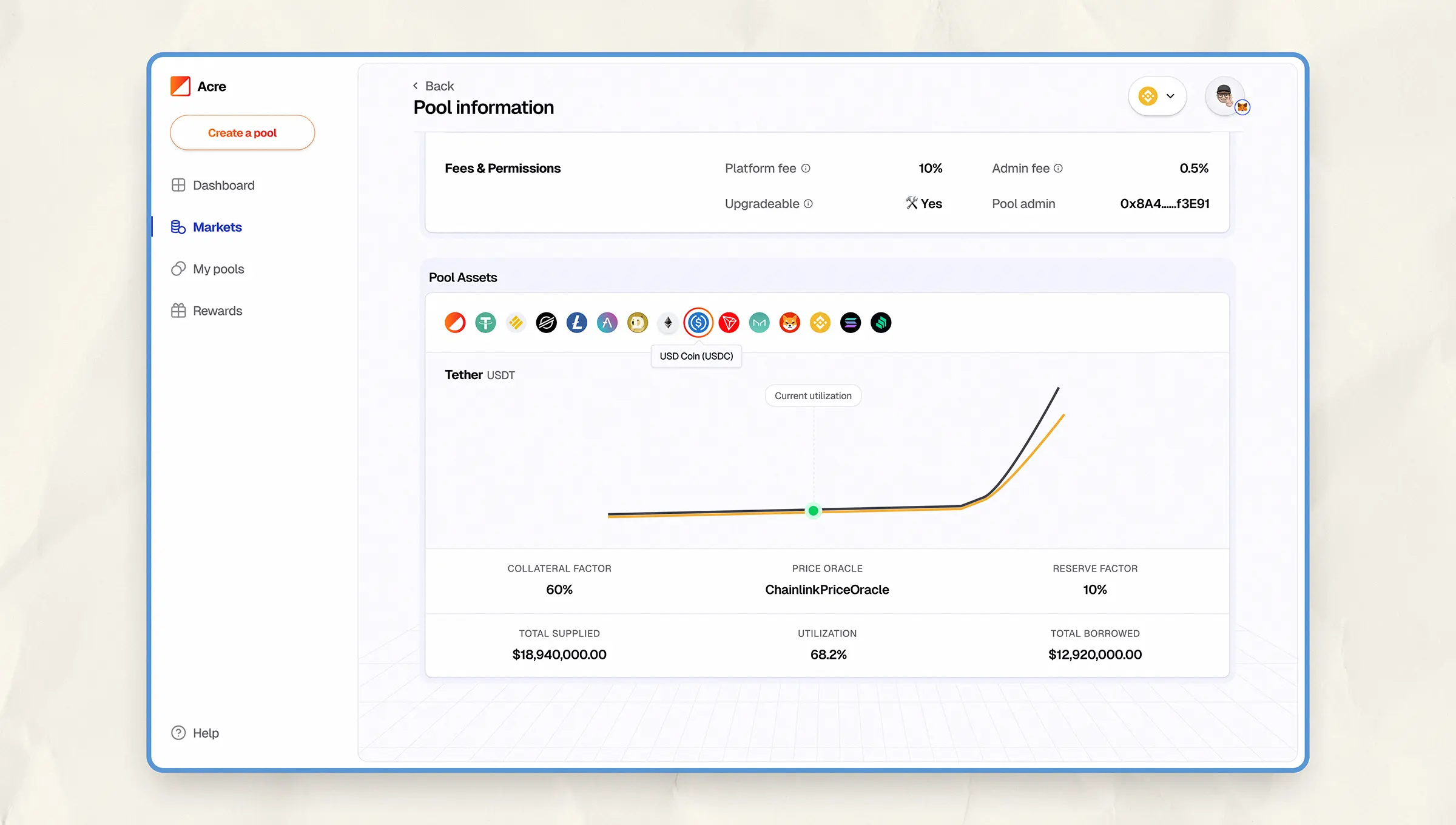

The pool info page surfaces deeper metrics: oracle configuration, fees, protocol settings, pool admin etc.

The pool token section visualizes interest curves and the data for all supported assets in the pool.

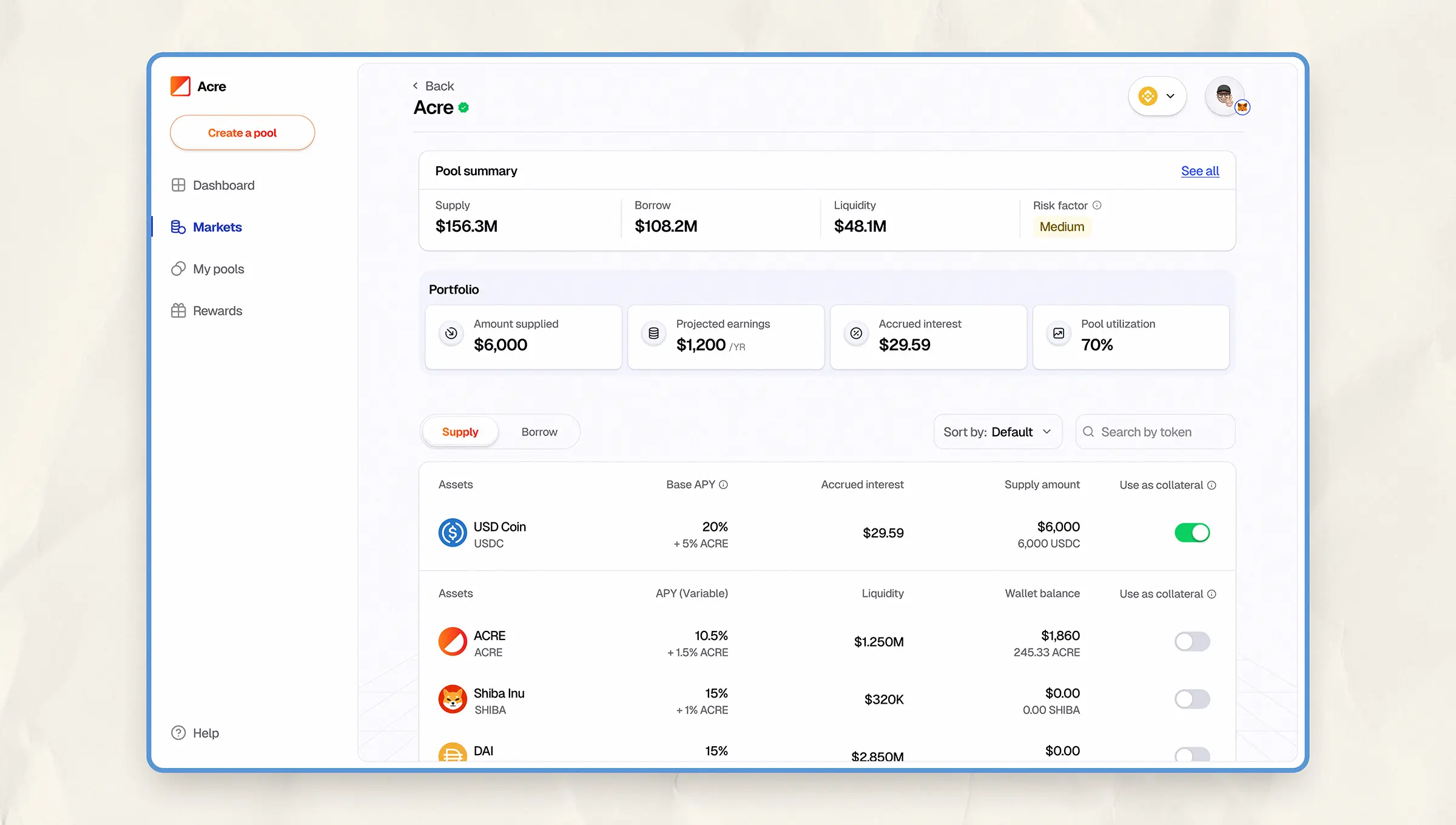

Navigating Lending and Borrowing with Confidence

Acre's borrowing and lending flows were designed for clarity and guardrails. Once a user entered a pool:

- The portfolio section summarized supplied assets, earnings, and accrued interest.

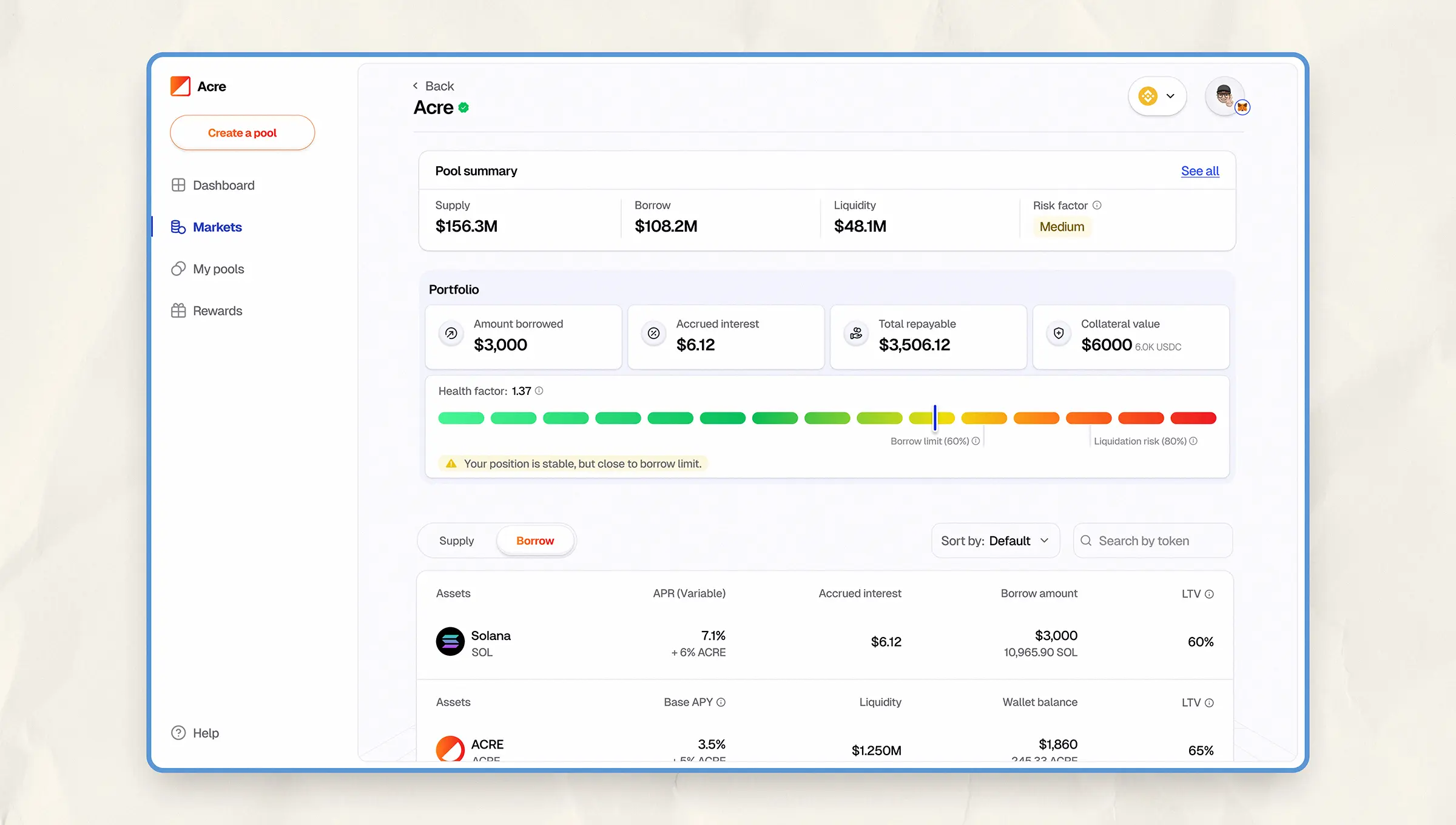

- Color-coded health indicators warned of risky liquidation zones.

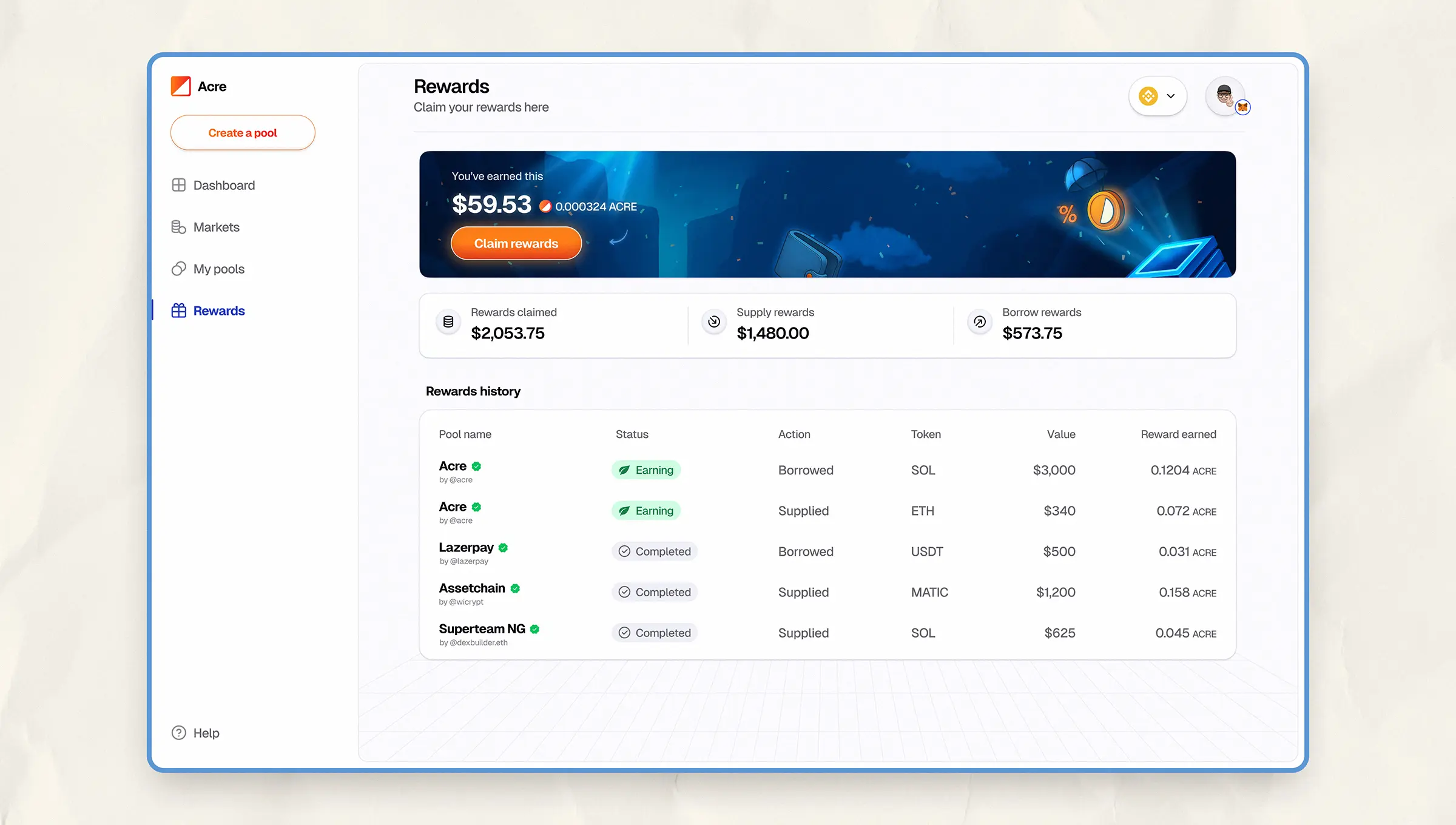

- Rewards for supply and borrow actions were clearly broken down in a dedicated section.

- Also, active pool positions were visible right from the dashboard.

After supplying, users see a personalized portfolio view showing the amount supplied and projected earnings. Collateral status is toggled directly within the asset list.

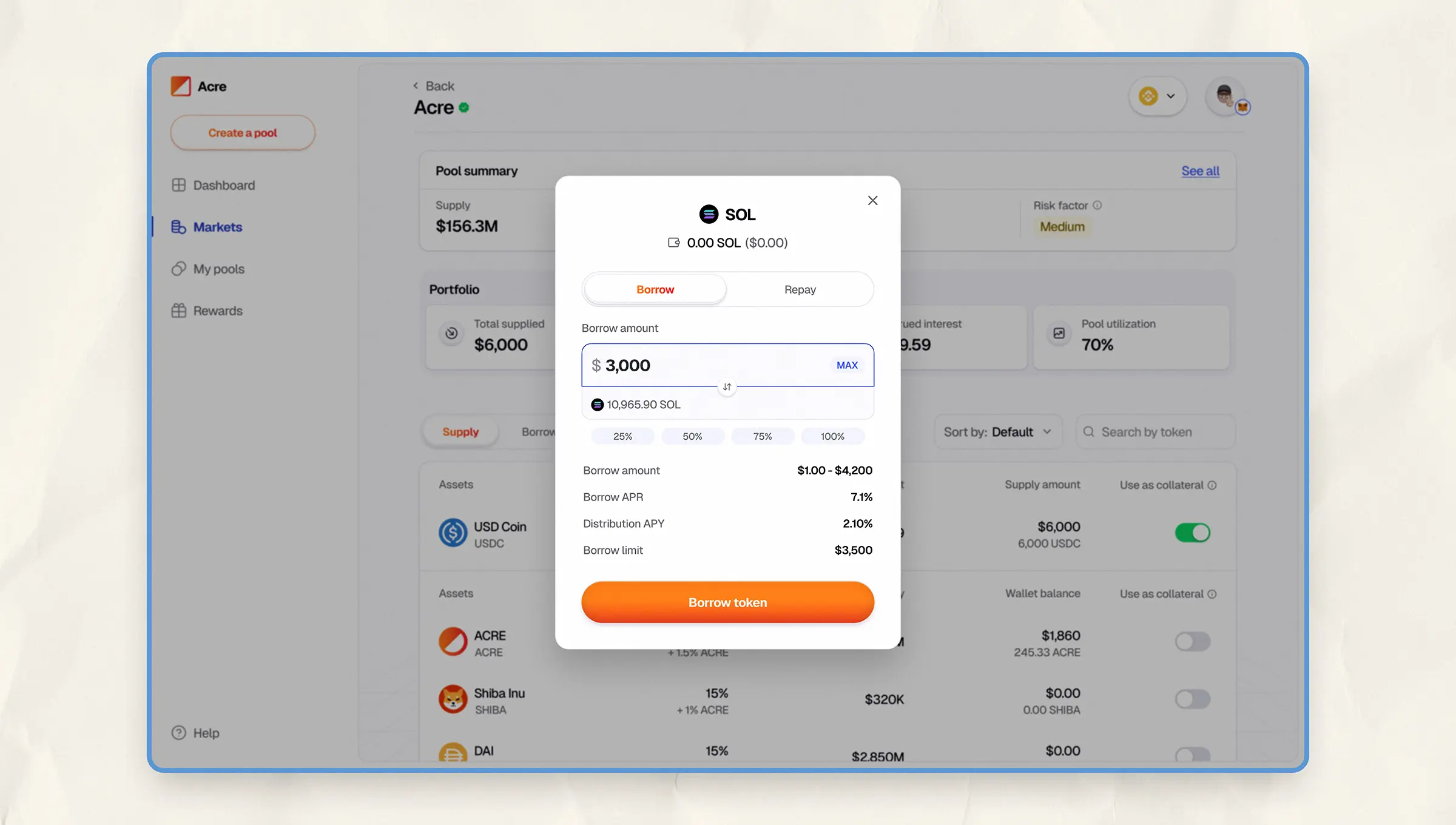

Borrow modal showing borrow amount, LTV, APR, and borrow limit information.

Pool page dashboard view after borrowing. The health factor gauge helps assess liquidation risk at a glance.

The rewards page lets users track what they earned, from which pool, and through what action.

Users always know which pools they’re active in. Those show up first with metrics tailored to their actions.

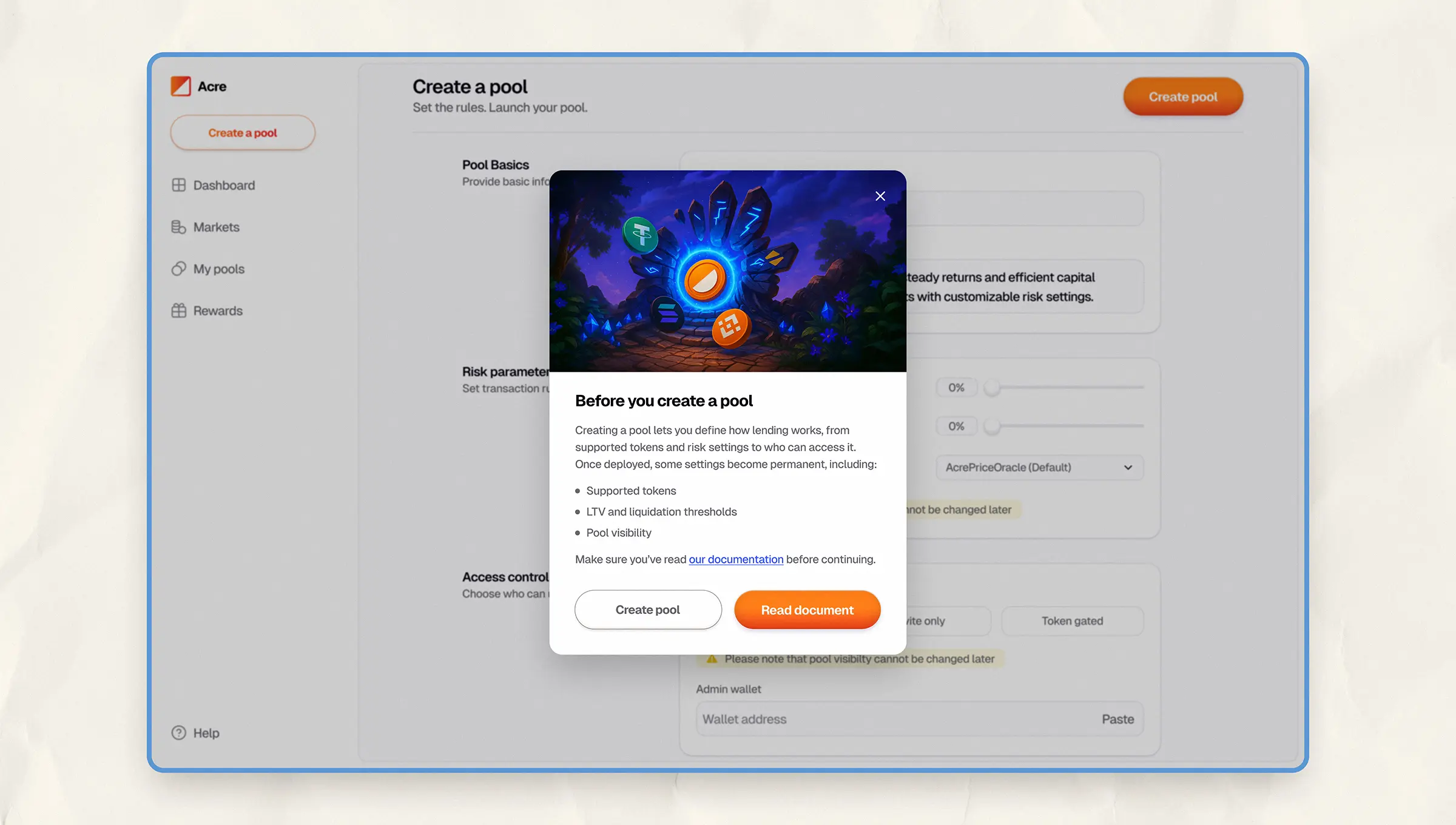

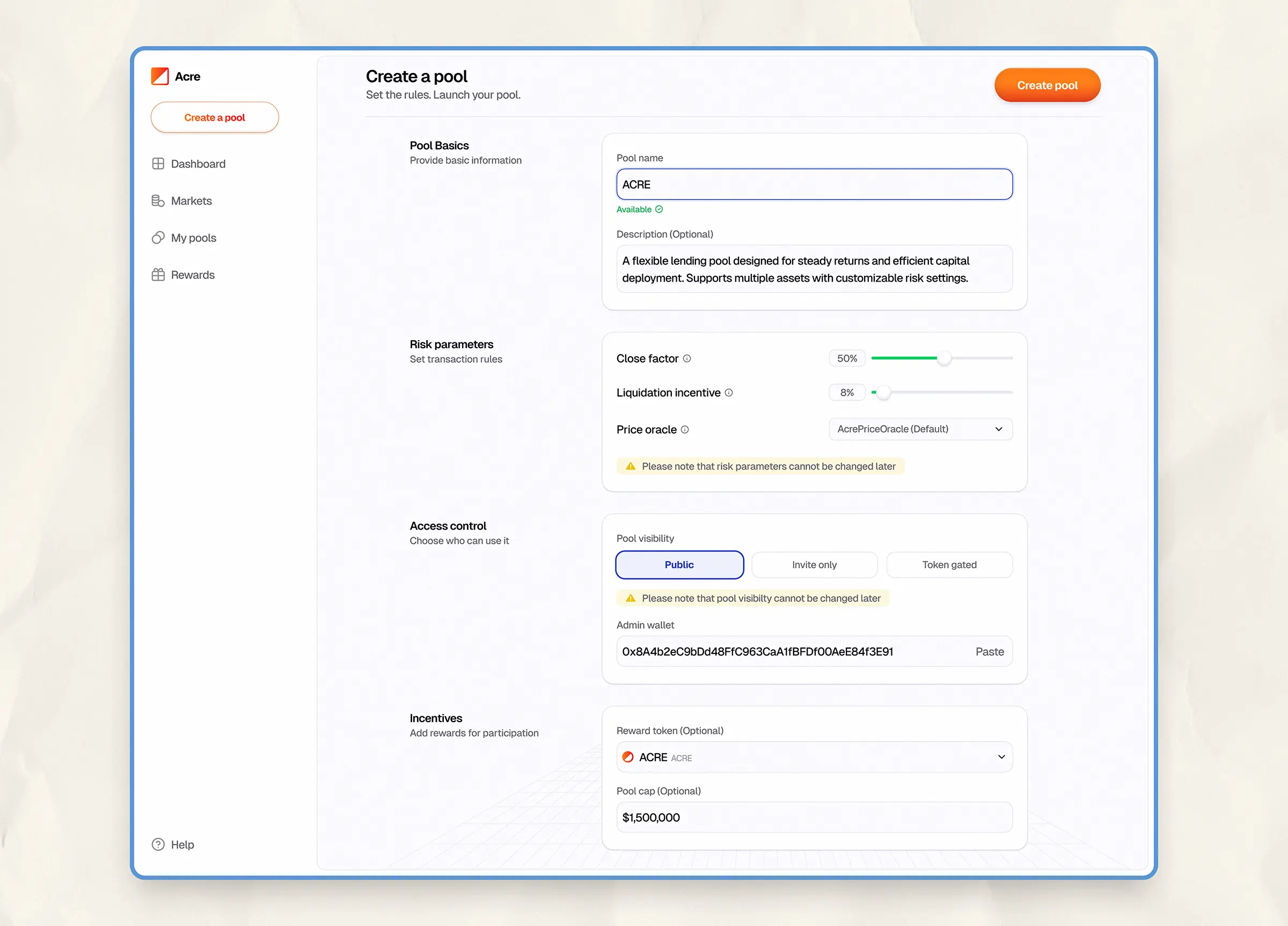

Designing a Flexible Yet Secure Pool Creation Experience

We wanted pool creation to feel both approachable and responsible, giving creators flexibility without sacrificing user safety.

- Guided creation flow walks users through naming, risk settings, access control, and reward setup, all in one view.

- A pre-launch checklist reinforces irreversible decisions like token selection and visibility, prompting users to double-check critical settings.

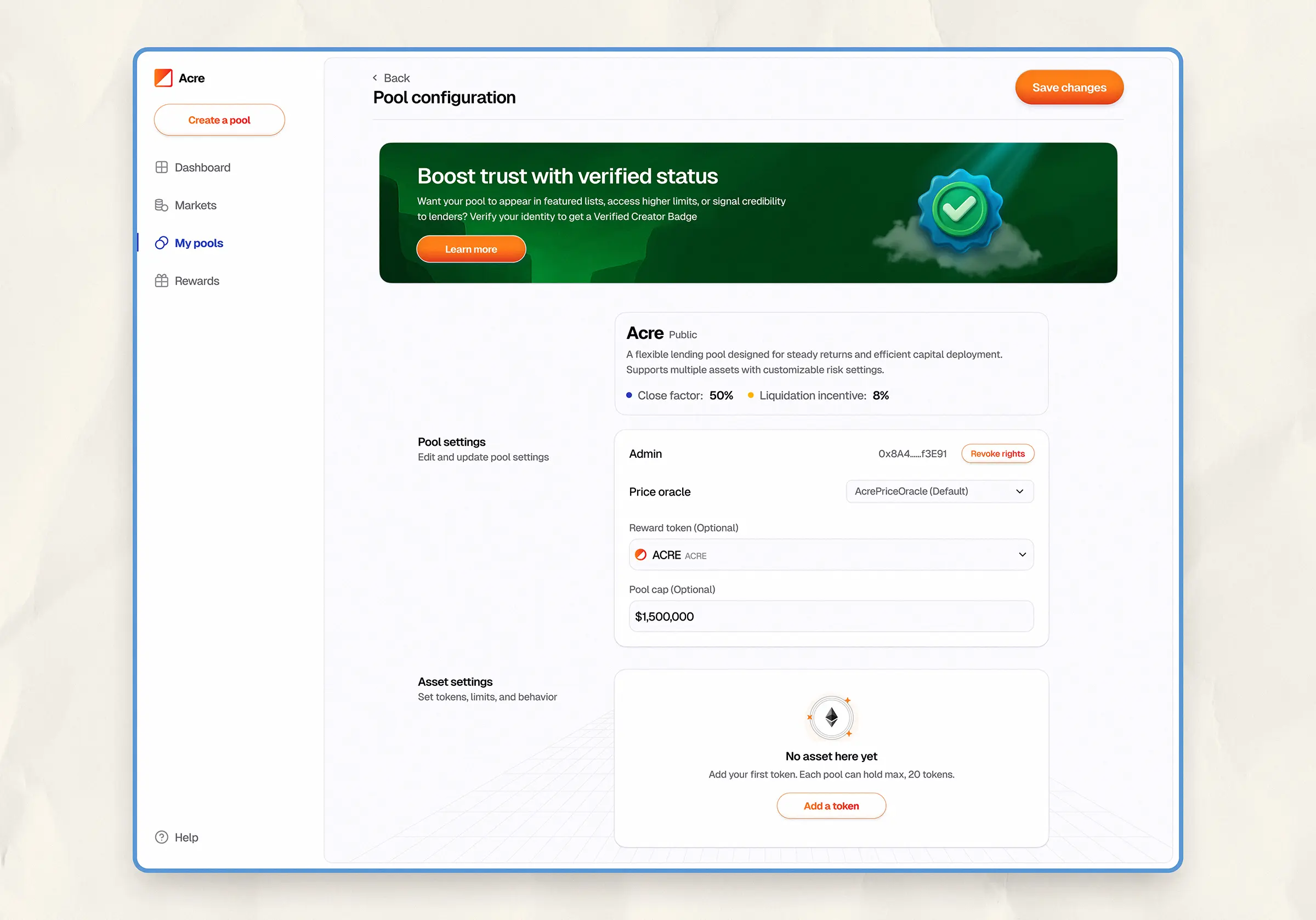

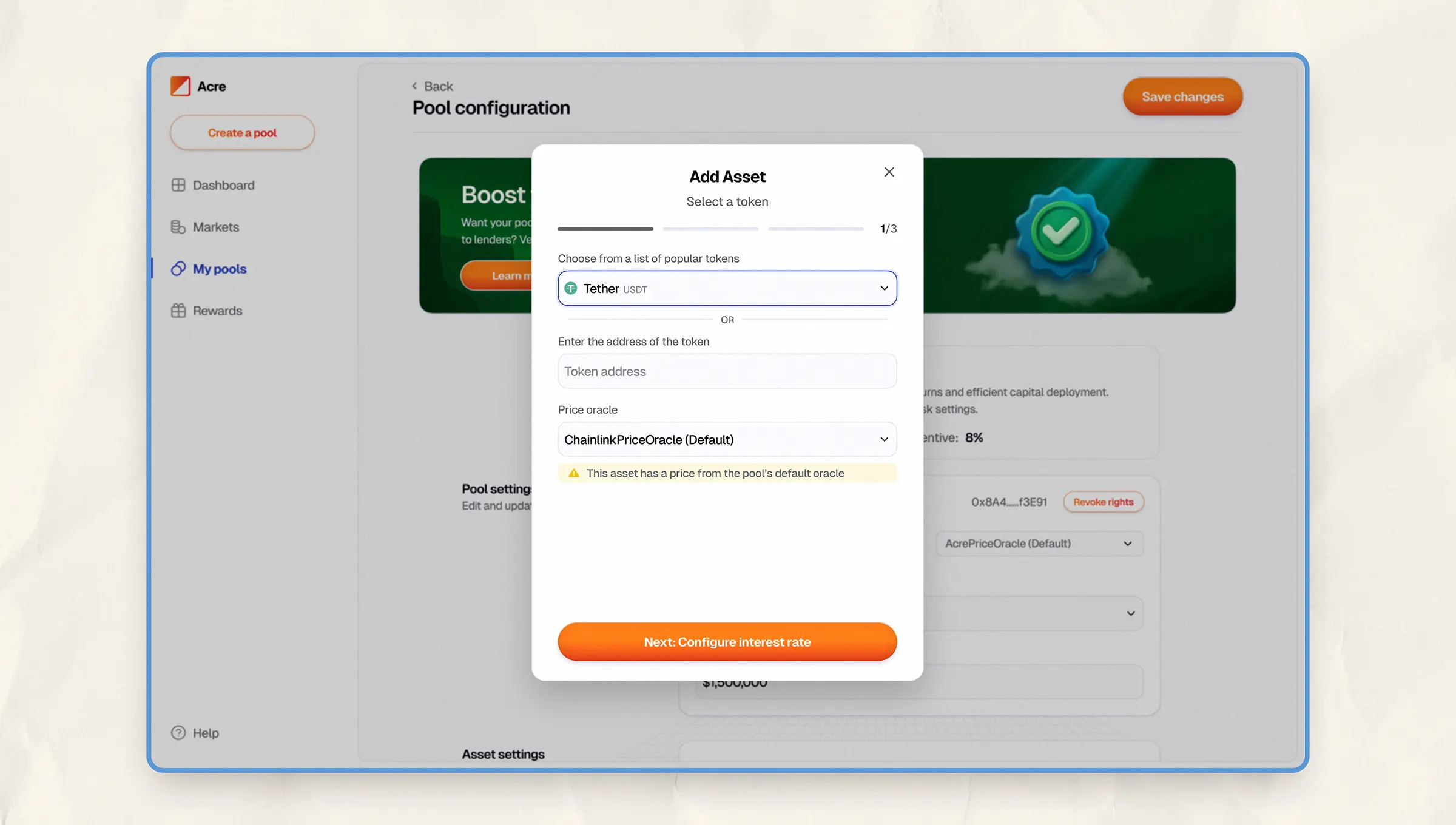

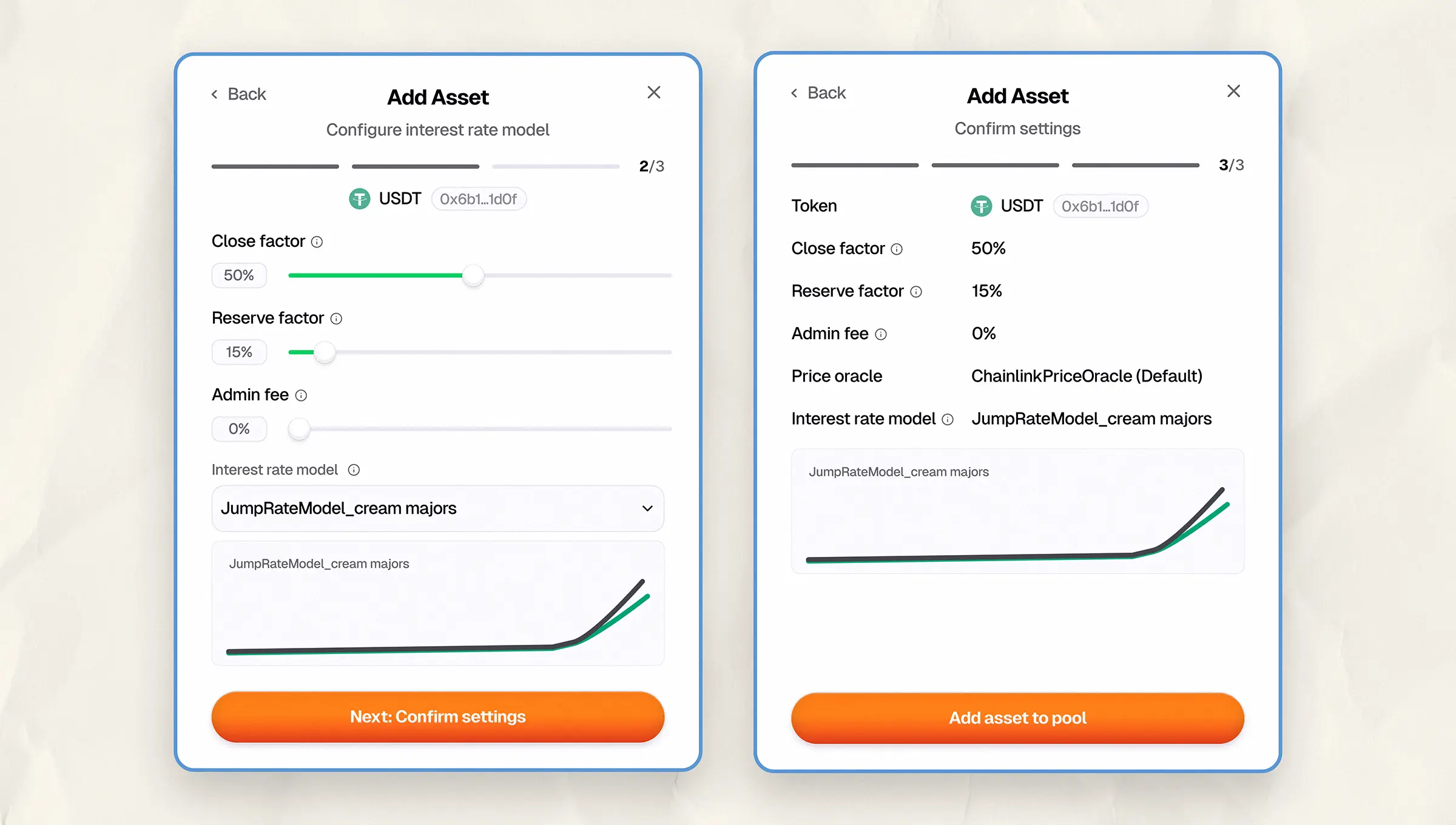

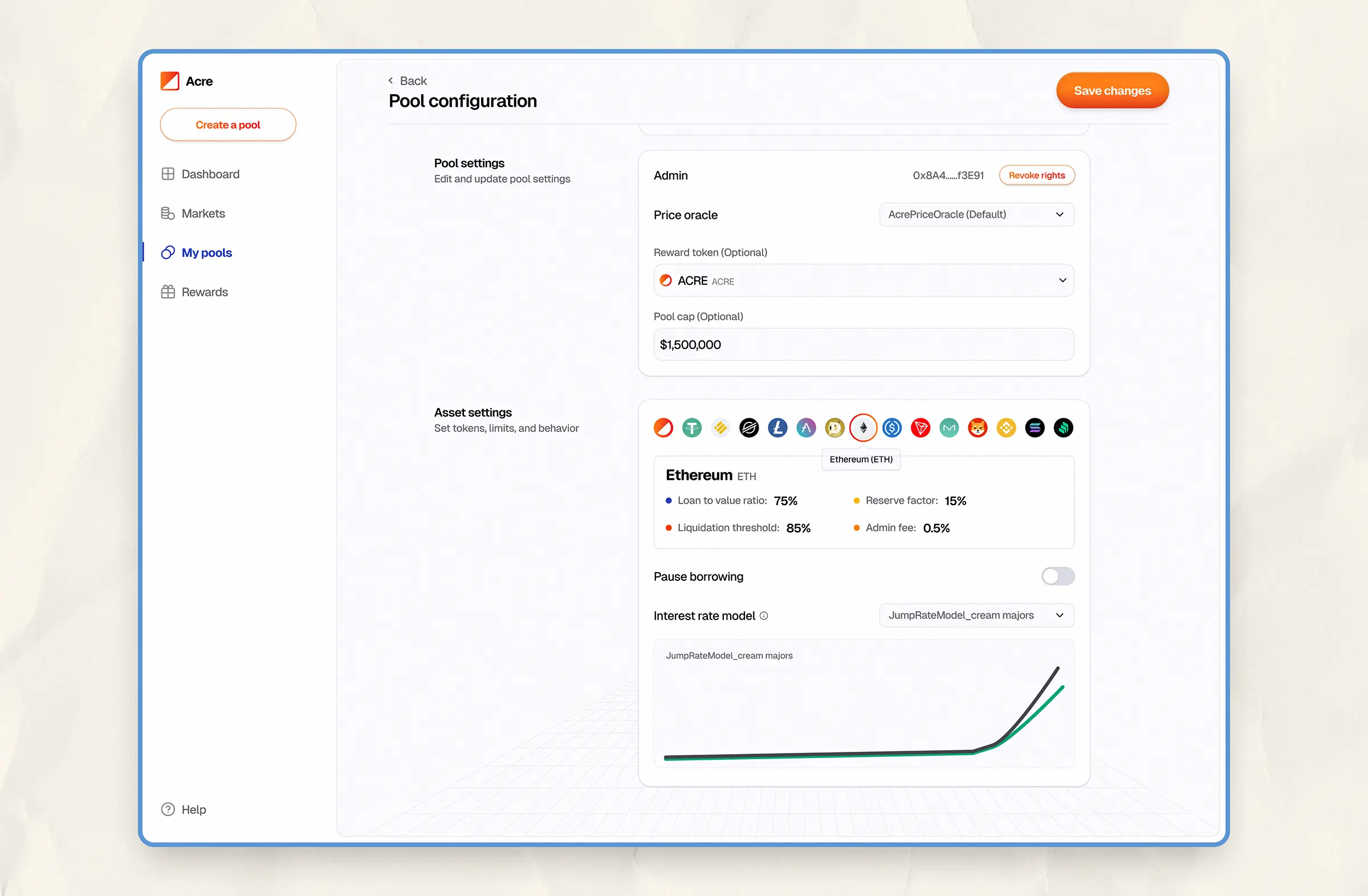

- Token addition flow includes clear steps to define oracles, reserve factors, and interest rate models.

- We also encouraged creators to verify themselves, improving transparency and earning user trust, especially in a permissionless environment.

Pre-creation modal prompting users to read documentation before pool creation.

Create Pool page with editable fields for name, risk, access, and incentives

Post-creation config screen prompting creator to add assets and verify pool.

1st step is to add a token to the pool. Users can choose or add a token manually and also select a price oracle.

Token configuration flow for adding an asset to a pool, showing interest rate model, fees, and close factor.

Pool configuration page showing added tokens, caps, and liquidation thresholds, with the option to make edits where available.

Conclusion

From exploring pools to managing risk to creating new lending markets, Acre was built to give users choice without confusion. Every edge case, every screen, was an attempt to make DeFi lending safer, more transparent, and genuinely permissionless.

Curious to learn about my approach or how it could apply to your product? Let's chat!

© 2024 Felix Enyinnaya. All rights reserved

Of all the places you could be on the internet, you chose to stop by here. Thank you!