Designing for trust: The design of BetDemand's DEFI lending platform

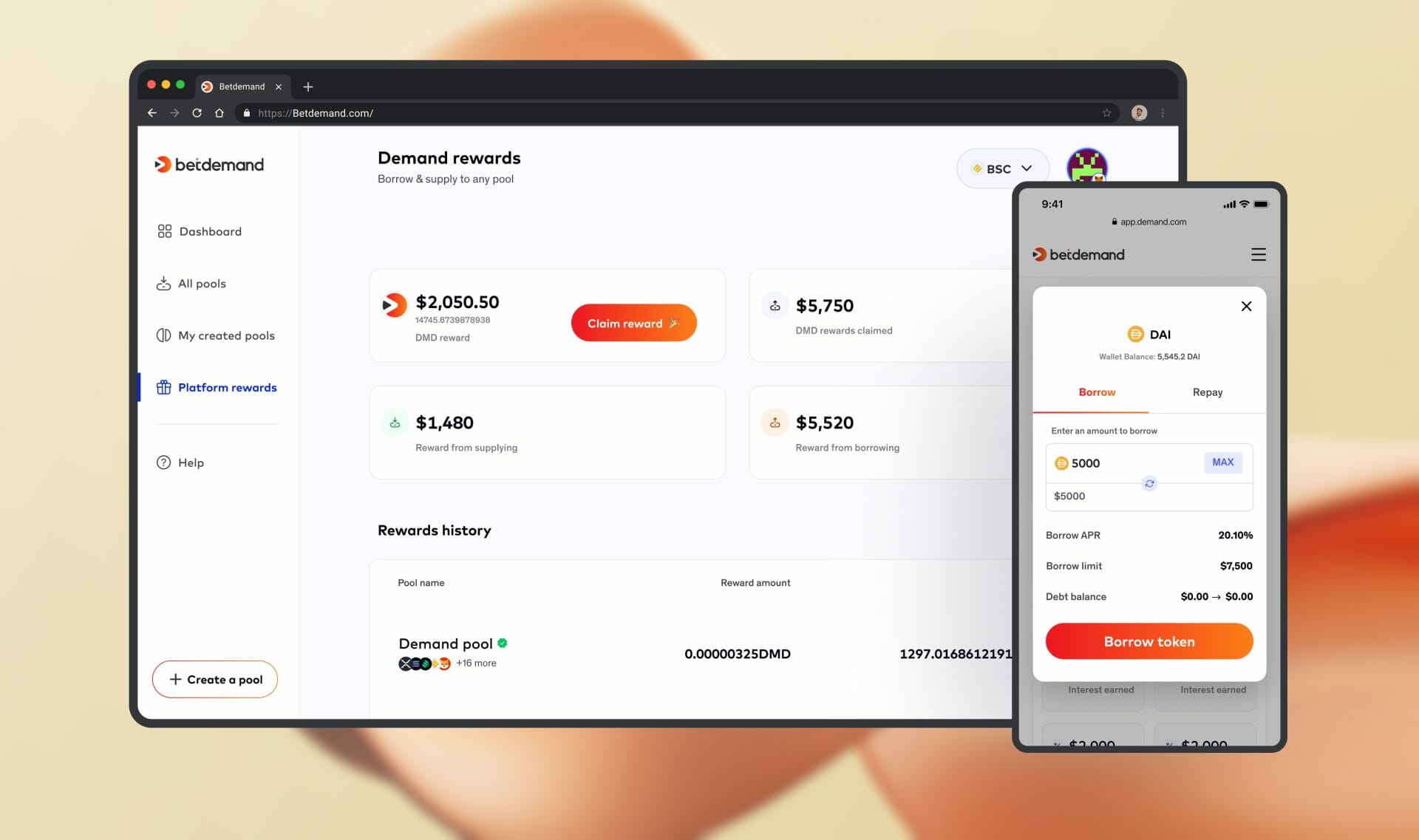

BetDemand operates a sports betting site using stable coins and supplies these tokens to Venus, a lending platform, in exchange for time-based rewards. Our task was to design BetDemand's own DeFi lending platform, enabling them to control the full value chain and allowing users to create their own borrowing and supply pools.

Business goals

Demand aims to create a user-friendly decentralized application where users can lend, borrow, and establish markets with ease.

This can be further broken down into the following

- Streamline the onboarding process to get users started without unnecessary hurdles.

- Simplify complex workflows by optimizing user journey

- Improve customer retention by minimizing friction

- Enhance customer acquisition by making the platform easy to use

ROLE

Lead Designer (UI/UX Design, Prototyping, Usability testing, System design)

team

Hugbo Clement - Product Lead

Enebeli Oluchi - Product Management & User Research

Marvellous Aigbe - Designer (Mobile)

timeline

6 Weeks

client

BetDemand (Now Stakefair)

Understanding the user's needs

Target users: Defi Natives

These users typically have a background in finance or substantial personal experience in investing. They're generally open to taking risks to achieve their financial goals.

Wants: To maximize profits through a high return on investment.

Needs: A trustworthy platform that offers both convenience and security in the investment process.

Pain points

- The DeFi landscape is ever-changing, making it challenging to keep up with new protocols

- Price volatility can impact investment performance significantly.

- Issues with keeping up with price volatility

- Multiple fees can eat into profits, especially when transferring cryptocurrencies across platforms.

To create a balance between business and user needs, our design solution aims to solve for these questions

1. What is the most important information for the users?

2. How do we solve for user motivations?

3. How might we build trust?

Guiding users to value through videos and written steps

Although this platform is for experienced Defi users, we also want beginners to access it. To make it easier for new users, we created an optional onboarding process. This step-by-step guide to using the site had both video and written instructions. You could skip this onboarding at any time.

Helping users decide: Providing key details for borrowing and lending

Understanding user motivations helped us figure out what information is most important to users before lending to or borrowing from a pool.

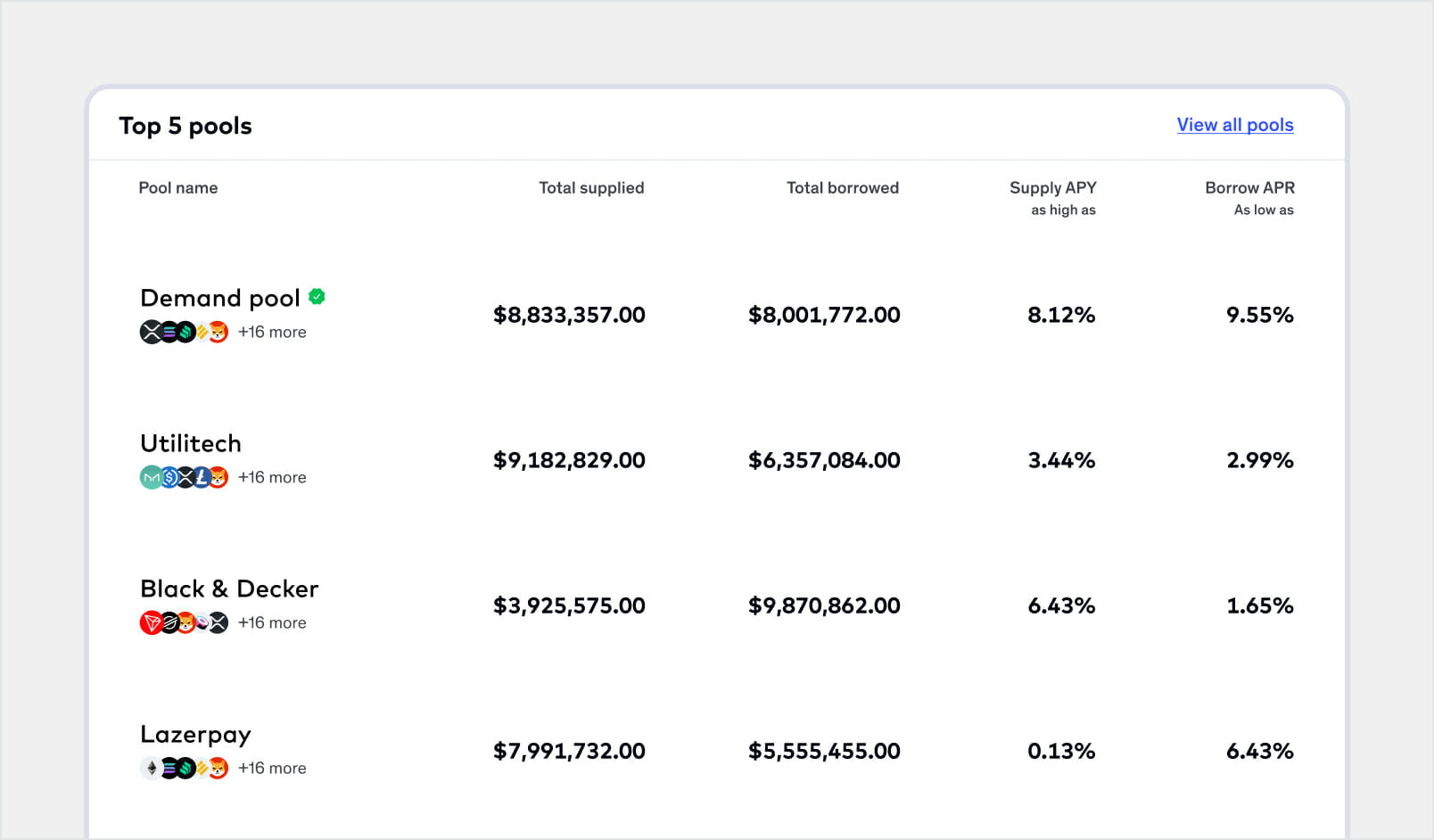

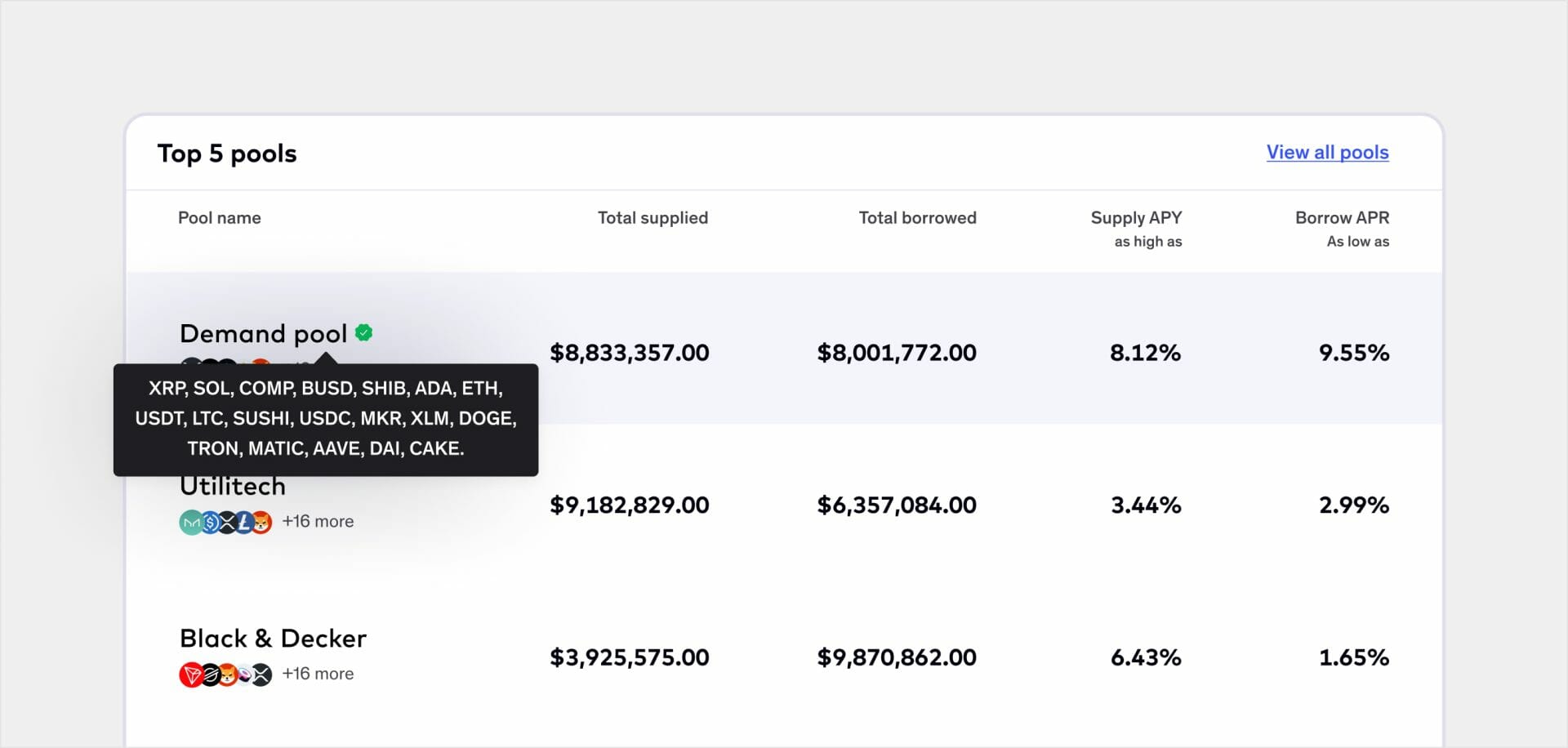

Based on what we learned from user research, we made sure that the section that lists the pools has all the information users need to take action. This shows the amount of money borrowed and lent, including the highest interest rate for lending and the lowest interest rate for borrowing.

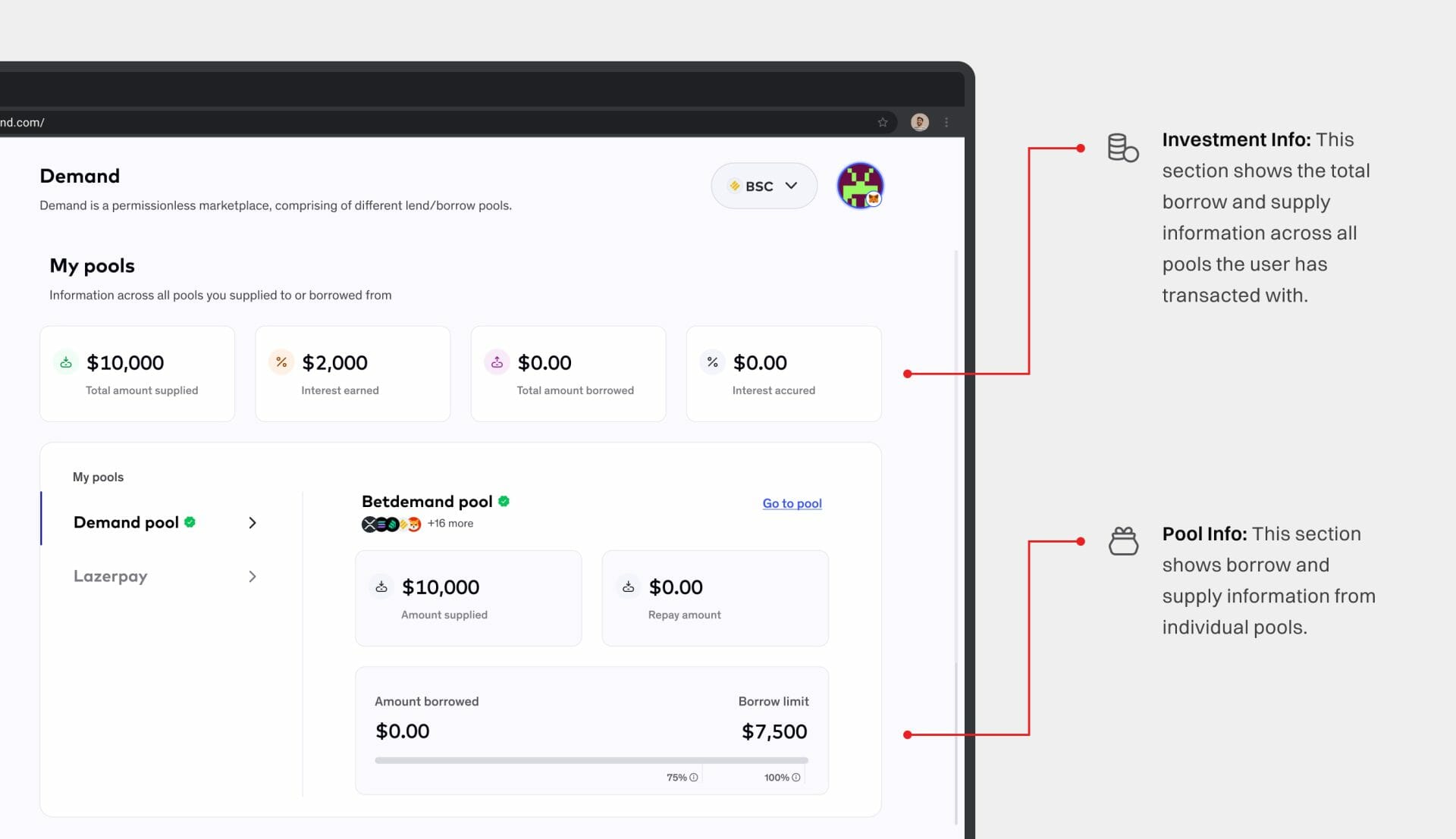

Unlike other platforms, after a borrowing or lending transaction, the dashboard page captures this information under the My Pools section. This makes it easy for the user to keep track of his transactions.

Our approach to building trust in BetDemand

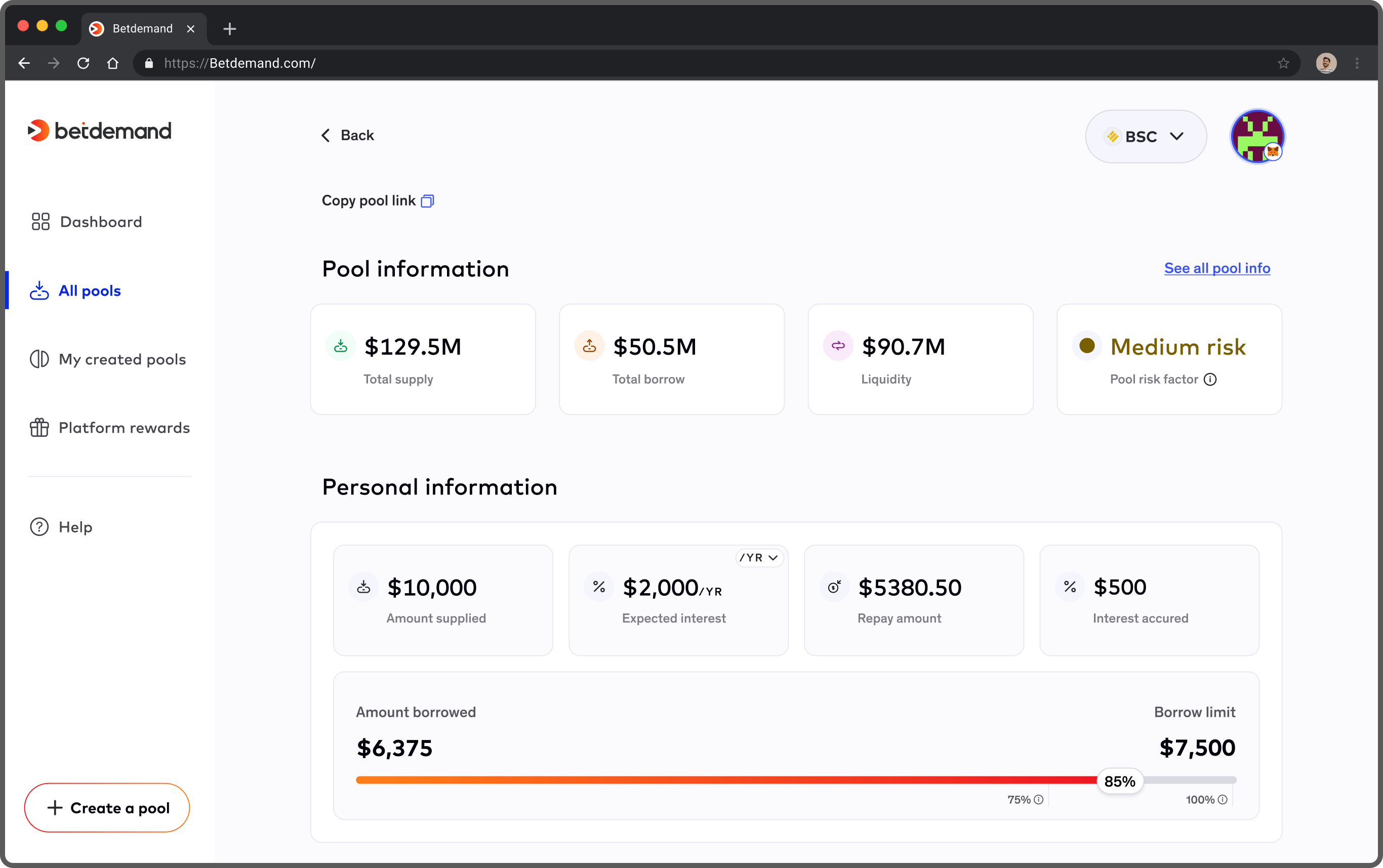

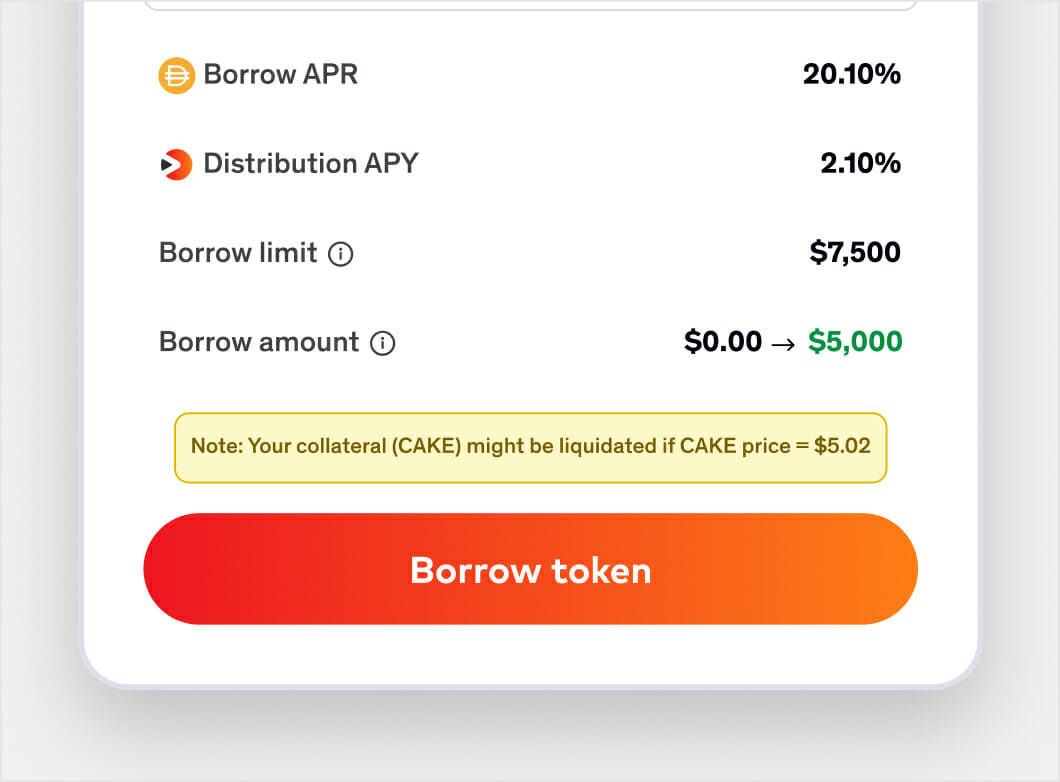

Two things were very important to us in order to build trust in BetDemand: Error prevention and transparency with liquidation risk. Liquidation happens when the value of the assets that were used as collateral falls below a certain level, which is usually your loan-to-value ratio (LTV). When this happens, the borrower either supplies more collateral or loses it to liquidators.

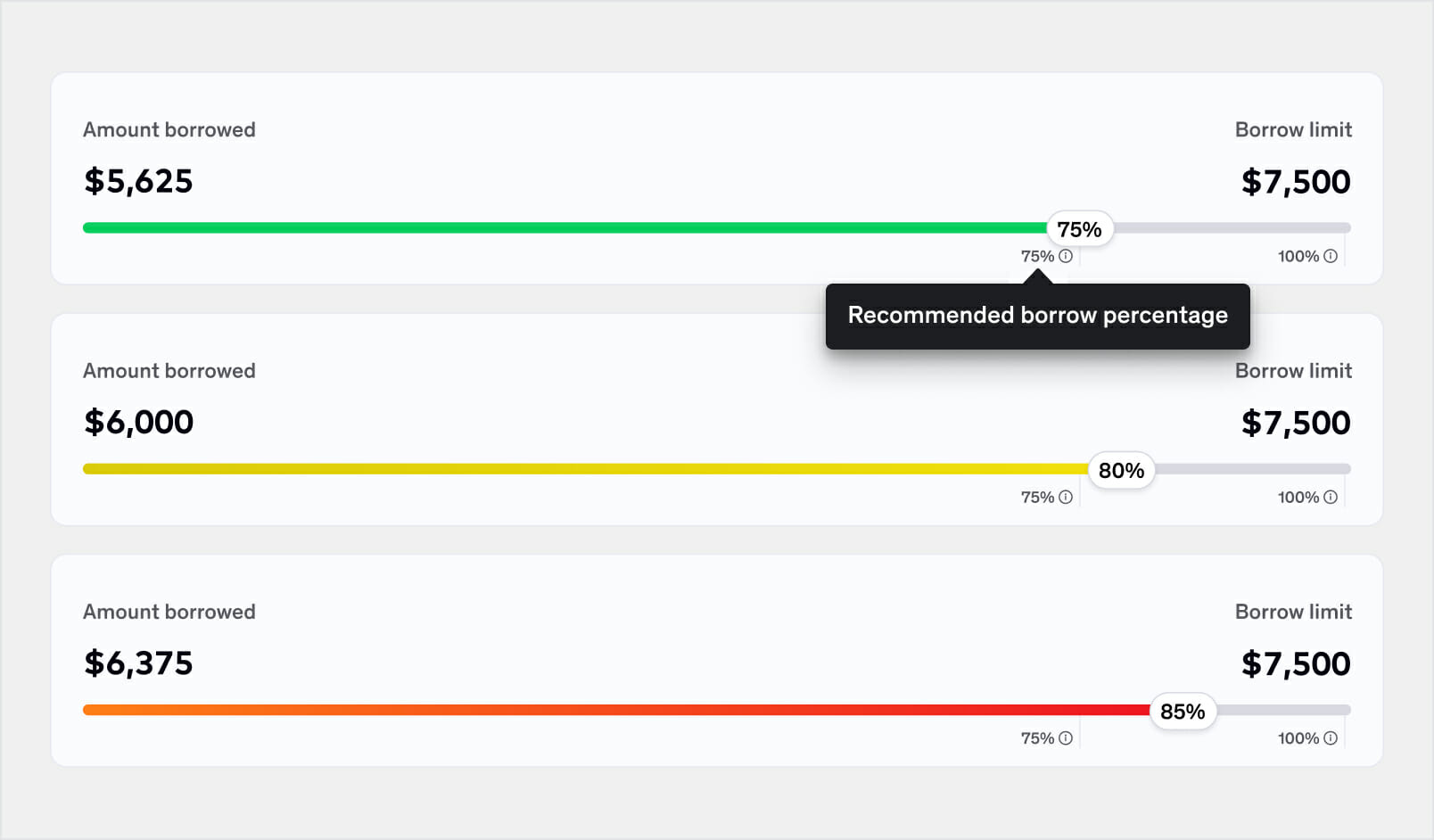

To solve this problem, we added a color-coded liquidation meter to quickly show the risk level of a borrow transaction and real-time warning banners for transparency.

Liquidation meters

Real-time Liquidation warning banner

Small steps, big impact: Enhancing BetDemand's user experience

After doing research on the competition, it was smart not to go in a different direction entirely. However, we did find a few small ways to improve the BetDemand user experience.

Writing for humans and reducing clutter

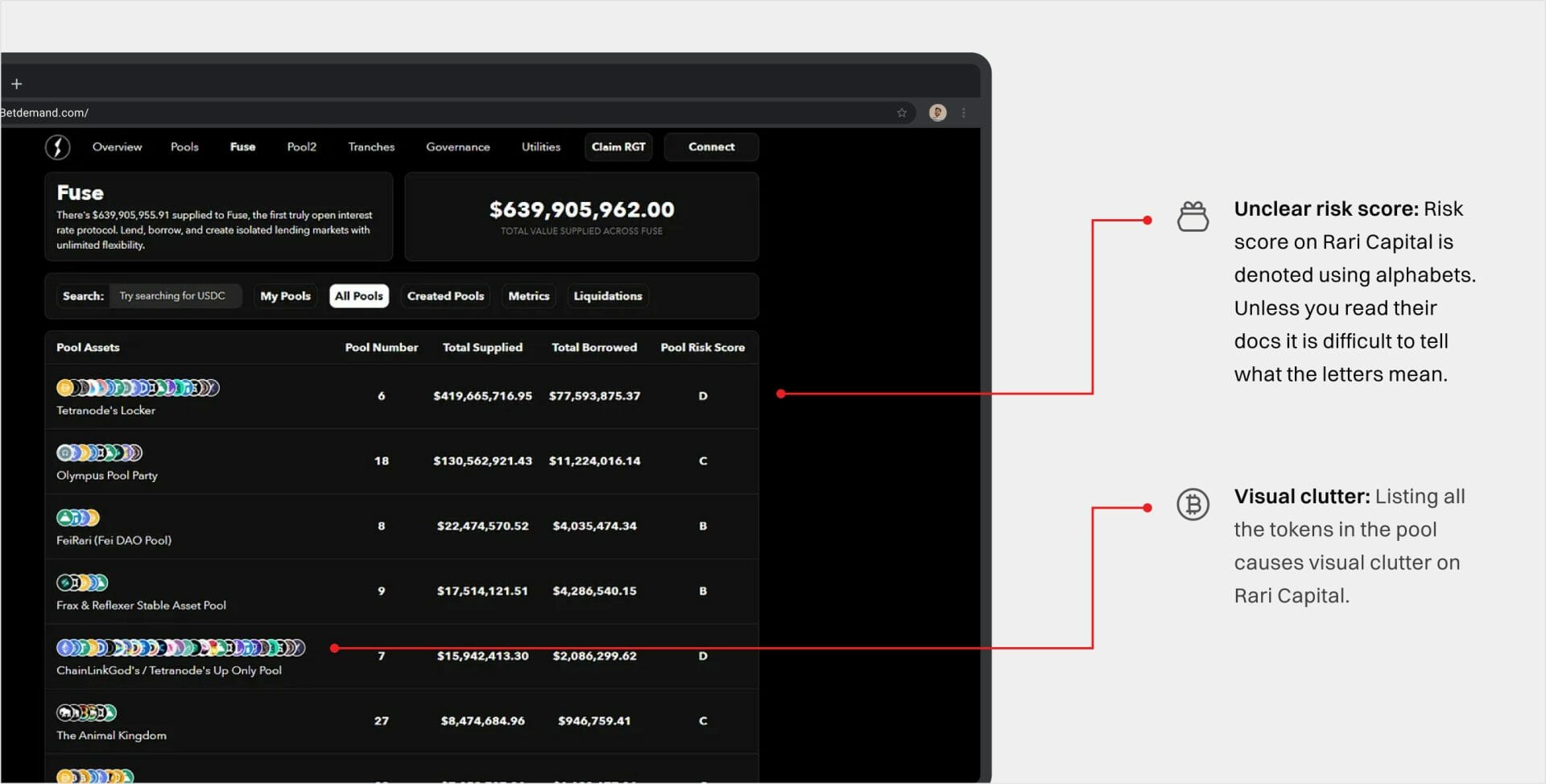

Below, you can see a screenshot of our main competitor, Rari Capital's Fuse.

Since users could make and own pools on both sites, a pool risk assessment was very important. Rari Capital' Fuse used letters to show the risk of a pool. The problem is that you can't tell if A is a bigger or lower risk without reading their documentation.

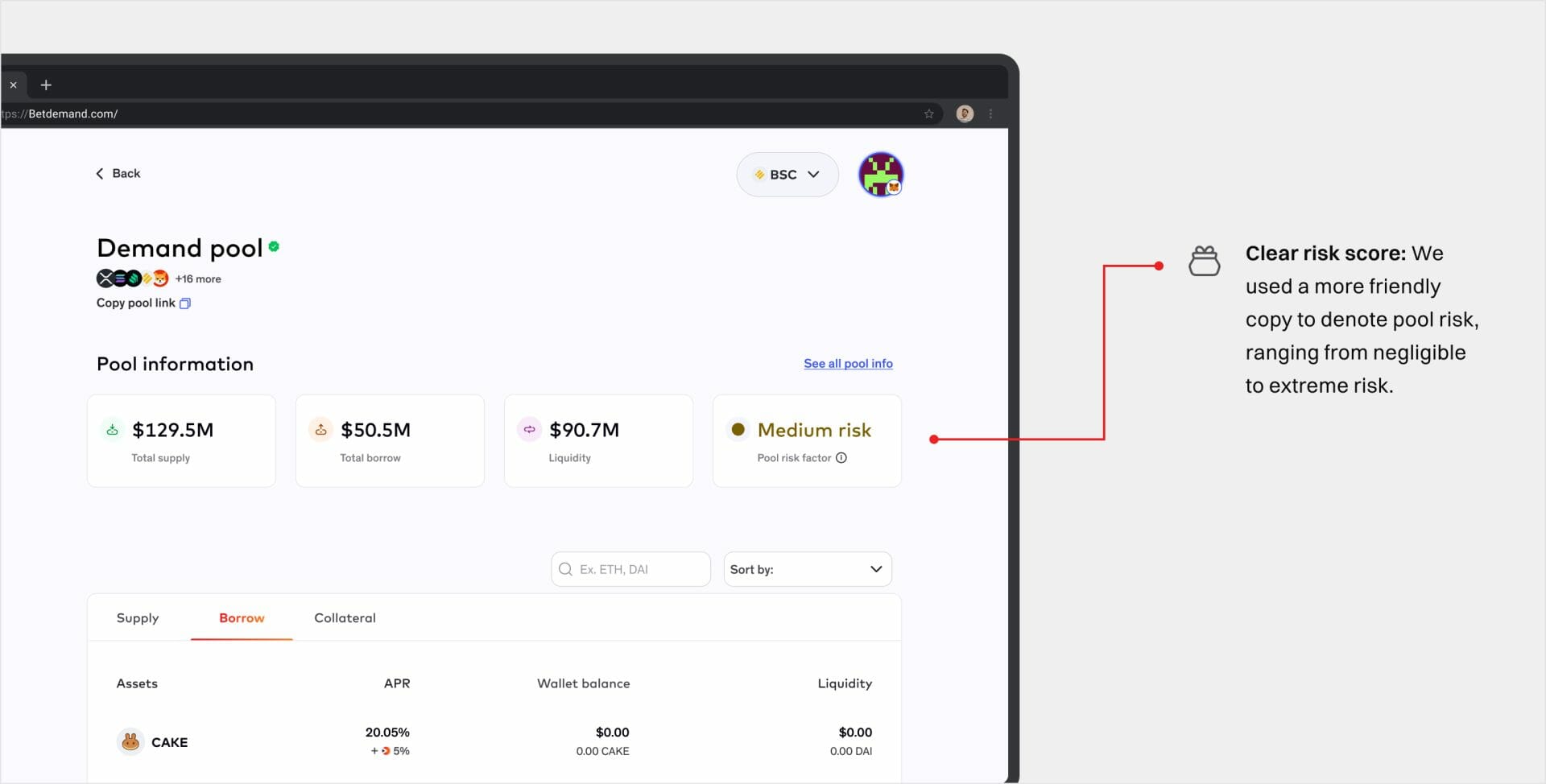

For BetDemand, we used simple, easy-to-understand language that helps borrowers and lenders decide quickly.

Using user-friendly copy to denote pool risk

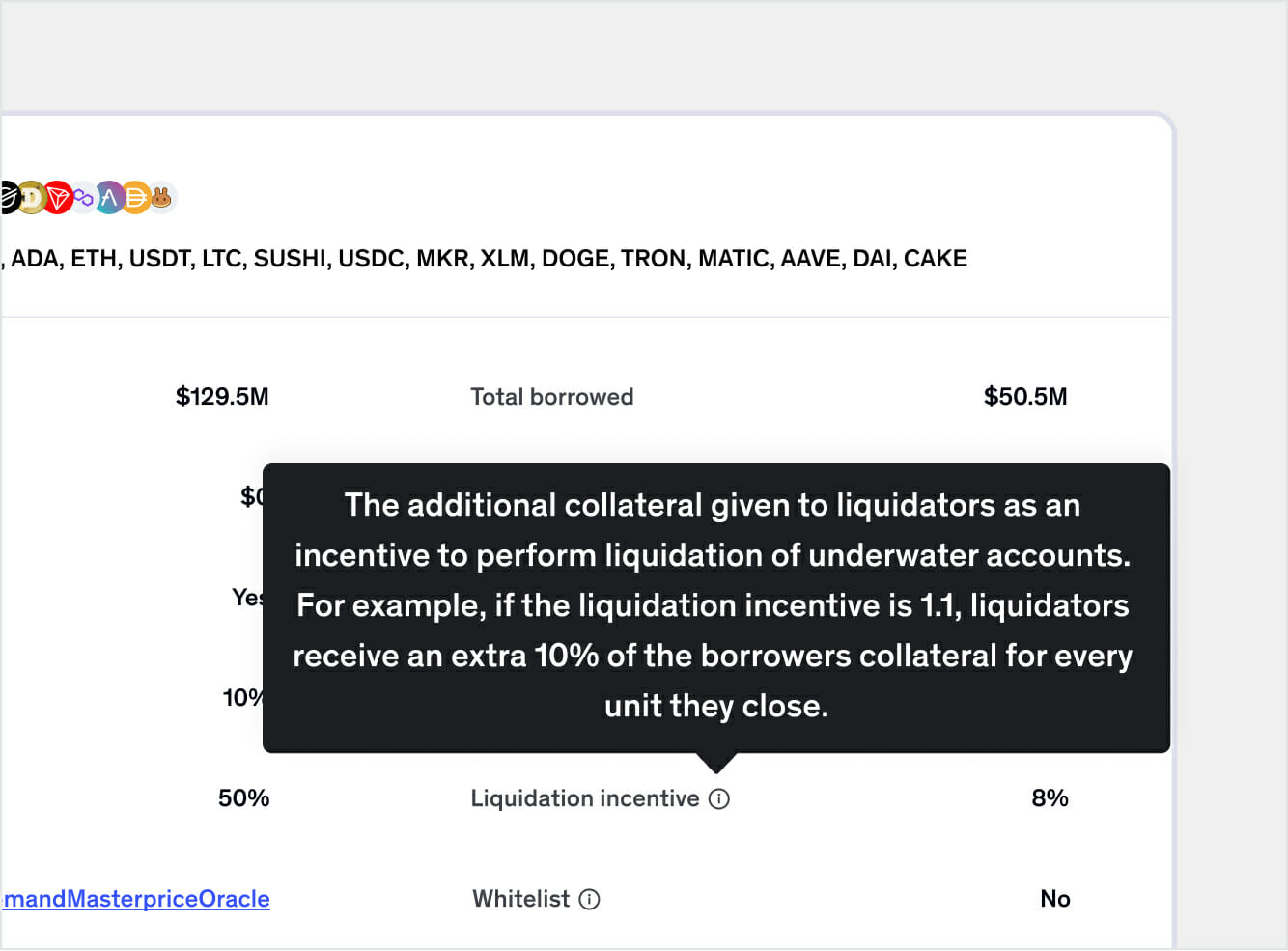

To solve for visual clutter in the pool list view, we showed only the first 5 tokens in the pool, but you could hover over them to see the whole list. This made it easier to scan the pool page.

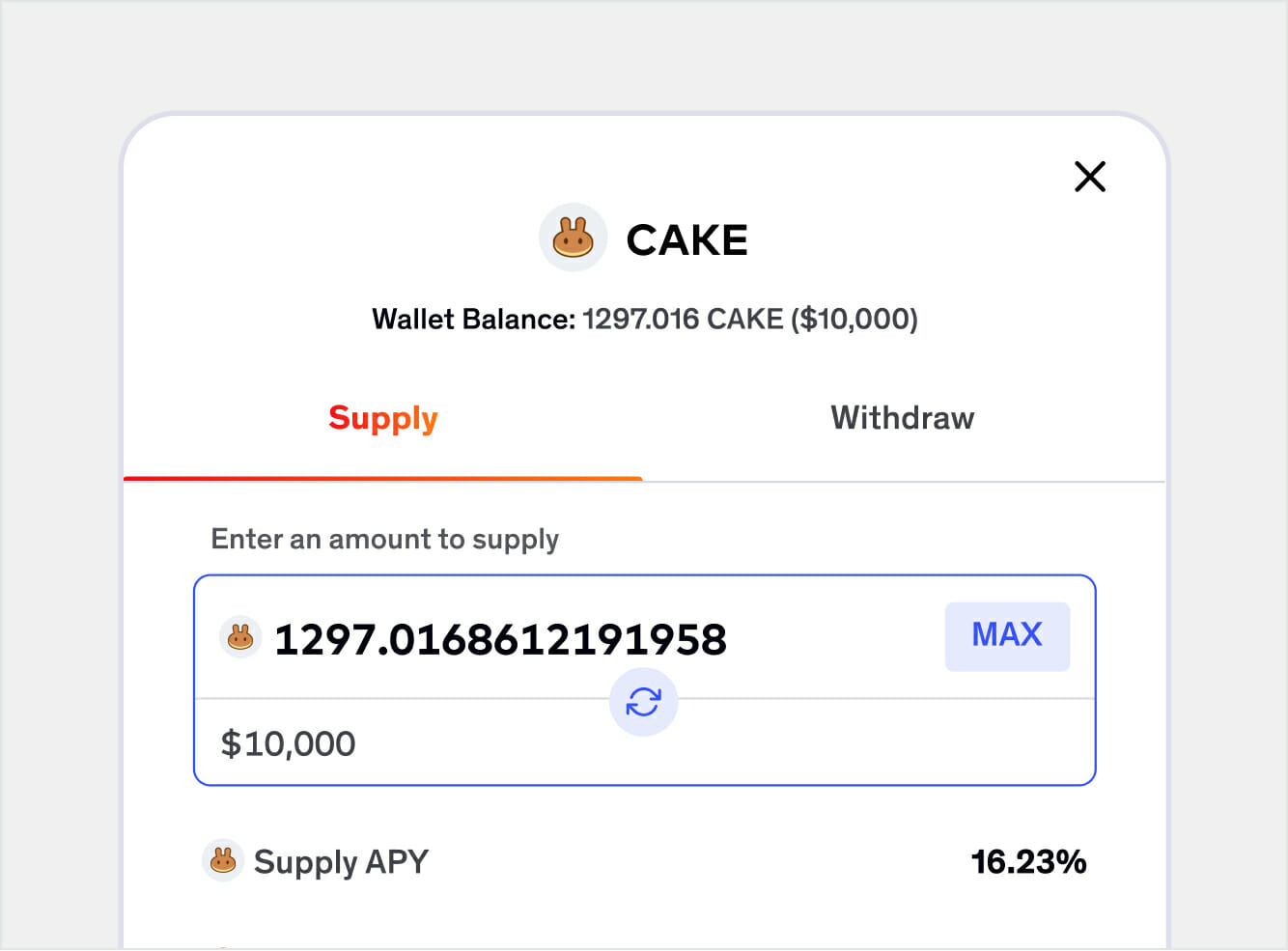

We also enhanced the platform's user experience by adding a 'Send Max' button and allowing users to input token amounts in dollar value, unlike other platforms. In addition, we leveraged tooltips to help explain unfamiliar concepts.

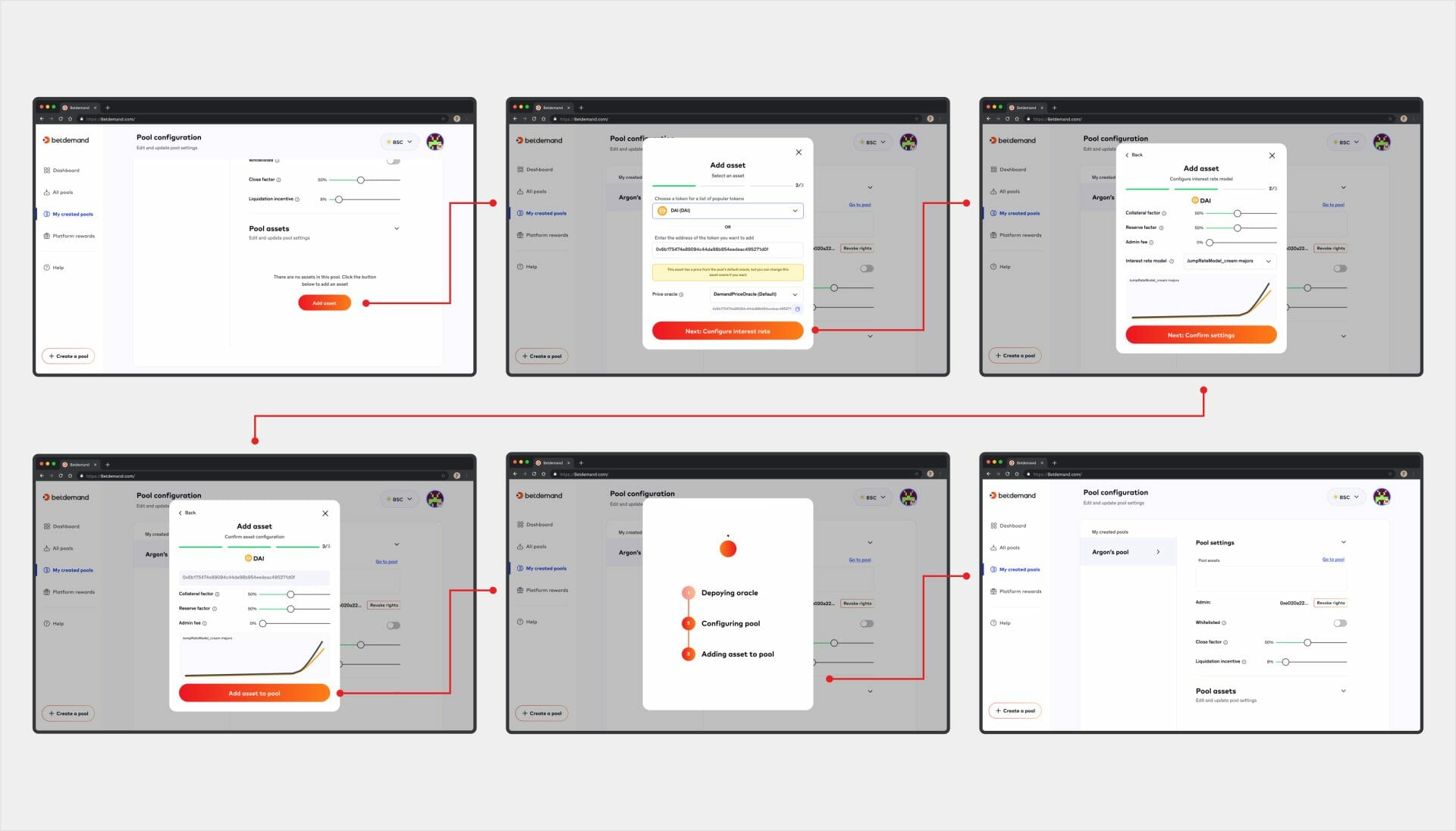

Simplifying complex tasks

To make complex tasks easier to understand, we broke them down into smaller steps across the DApp. Errors are also easier to spot and fix when there are smaller steps.

The image below shows the process of creating a pool broken down into 3 simple steps.

Learnings

Copywriting is crucial in designing digital products, especially for new technologies. Clear, simple, and concise copy free of jargon enhances user understanding and experience.